DEF 14A: Definitive proxy statements

Published on April 11, 2025

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o |

Preliminary Proxy Statement |

||||

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

||||

x |

Definitive Proxy Statement |

||||

o |

Definitive Additional Materials |

||||

o |

Soliciting Material Pursuant to §240.14a-12 |

||||

(Name of Registrant as Specified In Its Charter) | ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check all boxes that apply):

x |

No fee required |

||||

o |

Fee paid previously with preliminary materials |

||||

o |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

||||

3333 Deposit Drive Northeast

Grand Rapids, Michigan 49546

April 11, 2025

Dear Stockholder:

We cordially invite you to attend our 2025 Annual Meeting of Stockholders. The meeting will be held on Thursday, May 15, 2025, at 12:00 p.m. Eastern Time. The Annual Meeting will be held via conference call. You will be able to dial-in and participate in the Annual Meeting, vote your shares and ask questions during the meeting by dialing in 1-312-757-2166, conference room number 375-775-989.

Please review the Notice of Annual Meeting of Stockholders and proxy statement enclosed with this letter which describe the formal business to be transacted at the meeting.

Your vote is important to us. Whether or not you expect to attend the Annual Meeting, please vote your shares by signing, dating, and promptly returning the enclosed proxy card in the accompanying postage-paid envelope, or by voting online or by telephone using the instructions printed on the proxy card. This will ensure that your shares are represented at the Annual Meeting.

Thank you for your continued support of Northpointe.

| Sincerely, | |||||

|

|||||

Charles A. Williams |

|||||

Chief Executive Officer and Chairman of the Board |

|||||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 15, 2025

Northpointe Bancshares, Inc. (the “Company”) will hold its 2025 Annual Meeting of Stockholders, or the Annual Meeting, on Thursday, May 15, 2025, at 12:00 p.m. Eastern Time, for the following purposes, all of which are described in greater detail in the accompanying proxy statement:

1To elect seven (7) directors to serve until the next annual meeting of stockholders and until their successors have been duly elected and qualified;

2To ratify the appointment of RSM US LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2025; and

3To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. As of the date of this proxy statement, the Board of Directors is not aware of any other such business.

Only stockholders of record at the close of business on the April 4, 2025 (the “Record Date”) will be entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof. The holders of shares of the Company’s voting common stock are entitled to one vote per share on all matters to be presented for action by stockholders at the meeting.

It is important that your shares be represented and voted at the meeting. You can vote your shares online or by telephone, or by completing and returning the proxy card or voting instruction card sent to you. Voting instructions are printed on your proxy card and are included in the accompanying proxy statement. You can revoke a proxy at any time before its exercise at the meeting by following the instructions in the proxy statement.

The Annual Meeting will be held via a conference call. If you were a stockholder of record on April 4, 2025, or you hold a valid proxy for the Annual Meeting, you will be able to dial-in and participate in the Annual Meeting, vote your shares and ask questions during the meeting by dialing in 1-312-757-2166, conference room number 375-775-989.

Copies of our proxy statement and annual report for the year ended December 31, 2024 are available for viewing, printing and downloading on the Internet at www.investorvote.com/NPBI or in the “Investor Relations – SEC Filings” section of our website, www.northpointe.com. In addition, you may obtain free of charge electronic copies of all of our filings with the U.S. Securities and Exchange Commission from this section of our website.

The Board of Directors of the Company unanimously recommends that stockholders vote “FOR” each of the seven (7) director nominees for election as a director and “FOR” the ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2025.

BY ORDER OF THE BOARD OF DIRECTORS

Kevin J. Comps | ||

President and Secretary | ||

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE VOTE ONLINE OR BY TELEPHONE, OR BY MARKING, SIGNING, DATING AND PROMPTLY RETURNING THE ENCLOSED PROXY CARD OR VOTING INSTRUCTION CARD.

TABLE OF CONTENTS

| Page | |||||||||||

PROXY STATEMENT |

|||||||||||

GENERAL INFORMATION ABOUT THE ANNUAL MEETING |

|||||||||||

PROPOSAL 1 ELECTION OF DIRECTORS |

|||||||||||

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS |

|||||||||||

Corporate Governance Overview |

|||||||||||

| Board Leadership Structure | |||||||||||

Director Independence |

|||||||||||

Board Role in Risk Oversight |

|||||||||||

Cybersecurity and Information Security Risk Oversight |

|||||||||||

Non-Management Executive Sessions |

|||||||||||

Board and Committee Self-Evaluation |

|||||||||||

Board Meetings and Attendance |

|||||||||||

Committees of the Board |

|||||||||||

| Director Qualifications | |||||||||||

| Director Nominees | |||||||||||

| Stockholder Communication with Directors | |||||||||||

| Code of Business Conduct and Ethics | |||||||||||

| Corporate Governance Guidelines | |||||||||||

Insider Trading Policy |

|||||||||||

Corporate Responsibility |

|||||||||||

EXECUTIVE OFFICERS |

|||||||||||

EXECUTIVE COMPENSATION AND OTHER MATTERS |

|||||||||||

Summary Compensation Table |

|||||||||||

| Compensation Process | |||||||||||

Material Components of Compensation Program |

|||||||||||

Employment Agreements with Named Executive Officers |

|||||||||||

Outstanding Equity Awards at 2024 Fiscal Year-End |

|||||||||||

| 2024 Director Compensation | |||||||||||

Prohibitions on Hedging and Pledging |

|||||||||||

Clawback Policy |

|||||||||||

Delinquent Section 16(a) Reports |

|||||||||||

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS |

|||||||||||

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

|||||||||||

PROPOSAL 2 RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

|||||||||||

AUDIT COMMITTEE REPORT |

|||||||||||

STOCKHOLDER PROPOSALS |

|||||||||||

| GENERAL INFORMATION | |||||||||||

NORTHPOINTE BANCSHARES, INC.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 15, 2025

Unless the context otherwise requires, references in this proxy statement to “we,” “us,” “our,” “our company,” the “Company” or “Northpointe” refer to Northpointe Bancshares, Inc., a Michigan corporation, and its consolidated subsidiaries. All references to “the Bank” or “our Bank” refer to Northpointe Bank, a wholly-owned bank subsidiary of the Company. In addition, unless the context otherwise requires, references to “stockholders” are to the holders of outstanding shares of our voting common stock, no par value (the “common stock”).

This proxy statement is being furnished in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”) for use at the 2025 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held on Thursday, May 15, 2025 at 12:00 p.m., Eastern Time, and any adjournments or postponements thereof for the purposes set forth in this proxy statement and the accompanying notice of the meeting. This proxy statement, the notice of the meeting, the Annual Report on Form 10-K for the year ended December 31, 2024 (the “2024 Annual Report”), and the enclosed proxy card (collectively, the “proxy materials”) are first being sent to stockholders on or about April 11, 2025. You should read the entire proxy statement carefully before voting. The mailing address of the Company’s principal executive office is 3333 Deposit Drive Northeast, Grand Rapids, Michigan, 49546.

Important Notice Regarding the Availability of Proxy Materials for the 2025 Annual Meeting of Stockholders To Be Held on May 15, 2025

The Annual Meeting will be held via conference call. If you were a stockholder of record on April 4, 2025, or you hold a valid proxy for the Annual Meeting, you will be able to dial-in and participate in the Annual Meeting, vote your shares and ask questions during the meeting by dialing in 1-312-757-2166, conference room number 375-775-989.

Pursuant to the rules promulgated by the Securities and Exchange Commission (the “SEC”), the Company is providing access to its proxy materials both by sending you a full set of proxy materials and making copies of these materials available at www.investorvote.com/NPBI or in the “Investor Relations – SEC Filings” section of our website, www.northpointe.com. Stockholders are encouraged to access and review the proxy materials before voting.

1

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

How can I vote?

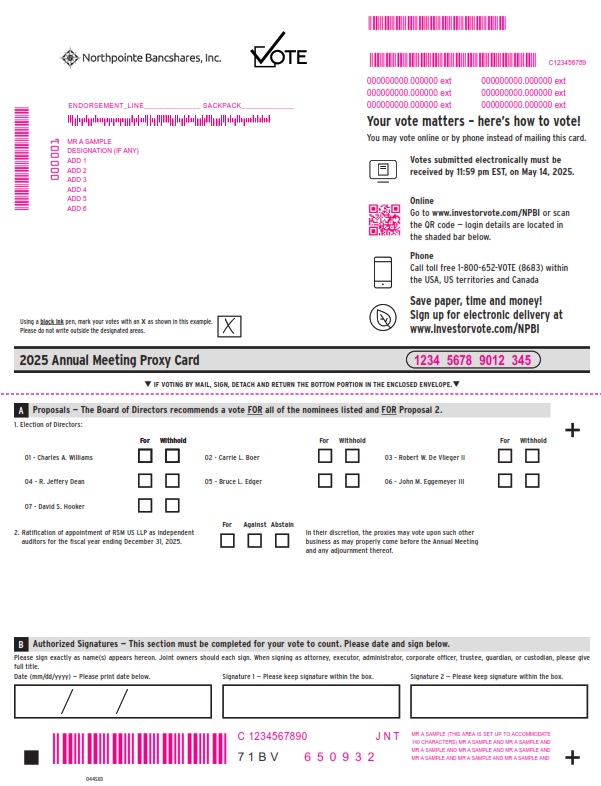

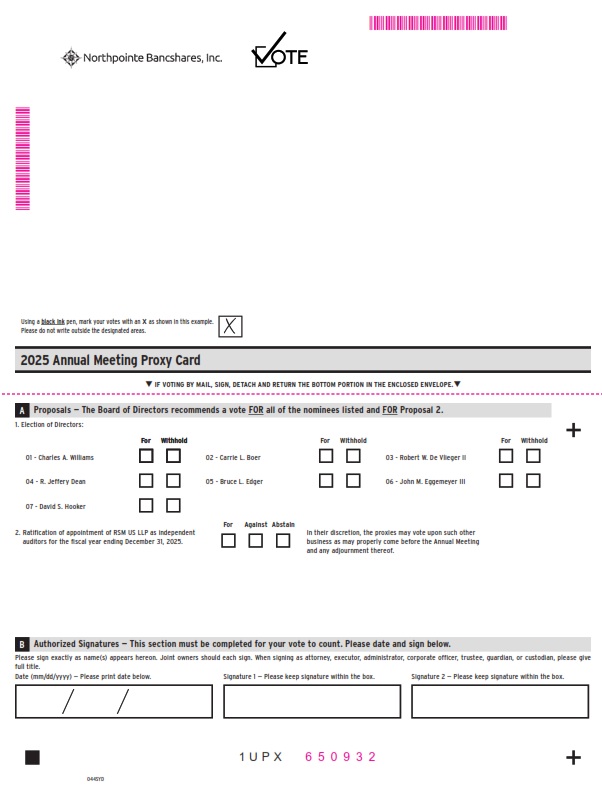

You may vote your shares of common stock either by proxy or during the Annual Meeting. The process for voting your shares depends on how your shares are held. If your shares are held in “street name,” follow the instructions provided by your bank, broker, or other nominee. If you are a record holder on the Record Date for the Annual Meeting, you can vote in one of four ways:

•Via Internet before the Annual Meeting: Go to www.investorvote.com/NPBI and follow the instructions. You may do this at your convenience, 24 hours a day, 7 days a week. You will need to have your proxy card in hand. The deadline for Internet voting is 11:59 p.m., Eastern Time, May 14, 2025.

•By Telephone: Call toll-free 1-800-652-VOTE (8683) and follow the instructions. You may do this at your convenience, 24 hours a day, 7 days a week. You will need to have your proxy card in hand. The deadline for voting by phone is 11:59 p.m., Eastern Time, May 14, 2025.

•In Writing: Complete, sign, date, and return the proxy card in the return envelope provided with your proxy card as soon as possible to ensure that it will be received in advance of the Annual Meeting.

•At the Annual Meeting: To attend the meeting via conference call and cast your vote, please dial in 1-312-757-2166, conference room number 375-775-989. You will be able to vote telephonically and submit questions during the meeting.

If you submit your proxy and voting instructions via the Internet or telephone, you do not need to mail your proxy card. The Company must receive your vote no later than the time the polls close for voting at the Annual Meeting for your vote to be counted at the Annual Meeting.

If you submit a proxy to the Company before the Annual Meeting, whether by proxy card, by telephone or by Internet, the person named as proxy will vote your shares as you direct. If no instructions are specified, the proxy will be voted for the seven directors nominated by the Board of Directors, for the ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2025, and in the proxy holder’s discretion on any other matters that are properly presented at the meeting or any adjournment of the meeting.

What constitutes a quorum for the Annual Meeting?

A quorum of stockholders is necessary to hold a valid stockholders meeting. A quorum will be present at a meeting of stockholders if at least a majority of the outstanding shares entitled to vote are represented in person or by proxy at the Annual Meeting. As of the Record Date, there were 30,342,919 shares of our common stock outstanding and entitled to vote. The inspector of election will determine whether a quorum is present at the Annual Meeting. If there is no quorum, any officer entitled to preside at or to act as secretary of the Annual Meeting may adjourn the meeting until a later date. We will count abstentions and broker non-votes, which are described below, in determining whether a quorum exists.

If my shares are held in “street name” by my broker, will my broker vote my shares for me?

Yes, but only if you give your broker instructions. If your shares are held by your broker (or other nominee), you should receive this document and an instruction card from your broker. Your broker will vote your shares if you provide instructions on how to vote. If you do not tell your broker how to vote, your broker may vote your shares in favor of ratification of the auditor appointment but may not vote your shares on the election of directors or any other item of business. However, your broker is not required to vote your shares if you do not provide instructions.

2

What is a broker non-vote?

Brokers are entitled to vote shares held by them for their customers on matters deemed “routine” under applicable rules, even though the brokers have not received voting instructions from their customers. The ratification of the appointment of our independent registered public accounting firm (Proposal 2) currently qualifies as a “routine” matter. Your broker, therefore, may vote your shares in its discretion on that routine matter if you do not instruct your broker how to vote on them. Your broker is prohibited from voting your shares on non-routine matters unless you have given voting instructions on that matter to your broker. The election of directors (Proposal 1) is a non-routine matter, so your broker may not vote on this matter in its discretion. If you do not give voting instructions with respect to the election of directors, your broker will need to return a proxy card without voting on this non-routine matter, which is referred to as a “broker non-vote.”

How are broker non-votes and abstentions treated?

Broker non-votes, as long as there is one routine matter to be voted on at the meeting, such as the ratification of the appointment of RSM US LLP here, and abstentions are counted for purposes of determining the presence or absence of a quorum. A broker non-vote or a withholding of authority to vote with respect to one or more nominees for director will not have the effect of a vote against such nominee or nominees (Proposal 1). Because the ratification of the appointment of the independent registered public accounting firm is considered a routine matter and a broker or other nominee may generally vote on routine matters, no broker non-votes are expected to occur in connection with the proposal to ratify the appointment of RSM US LLP as the Company’s independent registered public accounting firm. Any abstentions will not have the effect of a vote against the proposal to ratify the appointment of RSM US LLP as the Company’s independent registered public accounting firm (Proposal 2).

What if I return a proxy card but do not make specific choices?

If you are a stockholder of record and you return a signed and dated proxy card without marking any voting selections, your proxy will vote your shares “FOR” each of the seven (7) director nominees for election as a director and “FOR” ratifying the appointment of our independent registered public accounting firm for the year ending December 31, 2025. We are currently not aware of any other matters to be considered at the Annual Meeting. However, if any other matter is properly presented at the Annual Meeting, your proxy will vote your shares as recommended by the Board of Directors or, if no recommendation is given, will vote your shares using his discretion. If any director nominee becomes unavailable for election for any reason prior to the vote at the Annual Meeting, the Board of Directors may reduce the number of directors to be elected or substitute another person as a nominee, in which case your proxy will vote for the substitute nominee.

Can I revoke my proxy?

Yes. If you have not voted through your broker, you can change your vote after you have voted prior to the applicable cutoff time by:

1.delivering a written notice of revocation to Kevin J. Comps, Corporate Secretary of Northpointe Bancshares, Inc., 3333 Deposit Drive Northeast, Grand Rapids, Michigan, 49546;

2.submitting another properly completed proxy card prior to the meeting bearing a later date than your previous proxy;

3.voting by telephone at a subsequent time, in which case only your last telephone proxy submitted prior to the meeting will be counted;

4.voting by the Internet at a subsequent time, in which case only your last Internet proxy submitted prior to the meeting will be counted; or

5.voting telephonically at the Annual Meeting, but simply attending the meeting will not, in and of itself, revoke a proxy.

If you voted through your broker, please contact your broker to change or revoke your vote.

3

What vote is required to elect a nominee for director to the Board of Directors?

In the election of directors, if a quorum is present, directors are elected by a plurality of the votes cast at the Annual Meeting. This means that the candidates receiving the highest number of “FOR” votes will be elected. For purposes of the election of directors, failures to vote, abstentions, and broker non-votes will have no effect on the result of the vote.

What happens if a nominee is unable to stand for re-election?

The Board may, by resolution, provide for a lesser number of directors or designate a substitute nominee. In the latter case, shares represented by proxies may be voted for a substitute nominee. We have no reason to believe any nominee will be unable to stand for re-election.

What vote is required to ratify the appointment of RSM US LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2025?

The ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2025 will require the affirmative vote of the holders of a majority of the shares cast at the Annual Meeting and entitled to vote on Proposal 2. For purposes of the ratification of the appointment of RSM US LLP, failures to vote, abstentions, and broker non-votes will have no effect on the result of the vote.

How are voted counted?

Votes will be counted at the Annual Meeting by the inspector of election appointed by the Company for the Annual Meeting.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and hold shares in a brokerage account, you will receive a proxy card for shares held in your name and a voting instruction card for shares held in “street name.” Please complete, sign, date and return each proxy card and voting instruction card that you receive to ensure that all your shares are voted.

Who will pay for this proxy solicitation, and how will we solicit proxies?

The Board is asking for your proxy, and we will pay all of the costs of soliciting stockholder proxies. In addition to the solicitation of proxies via mail, our officers, directors and employees may solicit proxies personally or by other means of communication, without being paid additional compensation for such services. The Company will reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding the proxy materials to beneficial owners of common stock.

Are there any other matters to be acted upon at the Annual Meeting?

Management does not intend to present any business at the Annual Meeting for a vote other than the matters set forth in the notice. The proxies also confers on the proxy the discretionary authority to vote with respect to any matter properly presented at the Annual Meeting. If other matters requiring a vote of the stockholders properly come before the Annual Meeting, it is the intention of the person named in the accompanying form of proxy to vote the shares represented by the proxies held by him in accordance with applicable law and his judgment on such matters.

Where can I find the voting results?

The Company will publish the voting results of the Annual Meeting in a Current Report on Form 8-K, which will be filed with the SEC within four business days following the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary

4

results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

Who can help answer any questions I may have?

Stockholders who have questions about the matters to be voted on at the Annual Meeting or how to submit a proxy, or desire additional copies of the proxy statement, the proxy card, or the 2024 Annual Report should contact Bryan Barker, Director of SEC Reporting at Northpointe Bancshares, Inc., 3333 Deposit Drive Northeast, Grand Rapids, Michigan, 49546, via email at Bryan.Barker@northpointe.com, or by phone at (616) 426-4064.

5

PROPOSAL 1. ELECTION OF DIRECTORS

Pursuant to our Amended and Restated Bylaws (“Bylaws”), our Board of Directors is authorized to have not less than two nor more than 25 directors, unless changed by resolution of our Board. Our Board of Directors currently consists of seven members, all of whom will be elected annually at the Annual Meeting and serve one-year terms, until their successors have been duly elected and qualified. The exact number of directors may be fixed or changed from time to time within the range set forth in our Bylaws by the Board of Directors.

The Corporate Governance and Nominating Committee and the Board of Directors have nominated the individuals listed in the table below for election as a director of the Company for a one-year term expiring at the 2026 annual meeting of stockholders. The nominees were selected based upon a review of their qualifications including, but not limited to, extensive experience in banking and financial services as well as mortgages, investment management, operations, risk management, corporate finance, and accounting. The proposed nominees are willing to be elected and to serve as a director. If any nominee becomes unable to serve or is otherwise unavailable for election, which we do not anticipate, the incumbent Board of Directors may select a substitute nominee. If a substitute nominee is selected, the shares represented by your proxy will be voted for the election of the substitute nominee. If a substitute is not selected, all proxies will be voted for the election of the remaining nominees. All of the nominees currently serve as directors of the Company and the Bank.

No current director has any family relationship, as defined in Item 401 of Regulation S-K, with any other director or with any of our executive officers. During the previous 10 years, no director, person nominated to become a director, or executive officer of the Company was the subject of any legal proceeding that is material to an evaluation of the ability or integrity of any such person. There are no arrangements or understandings between any of the directors and any other person pursuant to which he or she was selected as a director except as disclosed below.

Under securities purchase agreements with certain Castle Creek entities, Castle Creek (as defined elsewhere in this proxy statement) has the right to designate a nominee to our Board of Directors. For the Annual Meeting, Castle Creek has designated John M. Eggemeyer III to serve on our Board of Directors. For further information, please see the section entitled “Certain Relationships and Related Transactions – Transactions with Castle Creek – Board Representation and Observer Rights” in this proxy statement.

The following table sets forth certain summary information about our director nominees, including their names, ages and year in which they began serving as a director of the Company.

| Name | Age | Position | Director Since | |||||||||||||||||

| Charles A. Williams | 62 | Founder, Chairman and Chief Executive Officer | 1998 | |||||||||||||||||

| Carrie L. Boer | 63 | Director | 2020 | |||||||||||||||||

| Robert W. De Vlieger II | 68 | Director | 1999 | |||||||||||||||||

| R. Jeffery Dean | 66 | Director | 1999 | |||||||||||||||||

| Bruce L. Edger | 73 | Director | 2005 | |||||||||||||||||

| John M. Eggemeyer III | 79 | Director | 2019 | |||||||||||||||||

| David S. Hooker | 66 | Director | 1999 | |||||||||||||||||

Charles A. Williams. Mr. Williams is the Founder, Chairman, Chief Executive Officer, and director of the Company and the Chief Executive Officer and director of our Bank. Mr. Williams has over 42 years of experience in the banking industry. Prior to becoming Chief Executive Officer of the Company and our Bank in 1998, Mr. Williams served as a Senior Vice President, Senior Lending Officer, and Director of First National Bank of America (formerly named First National Bank of Michigan), where he was employed from 1988 through 1997. His responsibilities included originating, negotiating, approving, and administering loans similar to those originated and made by our Bank. At First National Bank of America, Mr. Williams served on the executive committee of the board of directors and participated on all major senior management committees. Mr. Williams has a degree from the Graduate School of Banking at the University of Wisconsin.

6

We believe that Mr. Williams’ knowledge of the Company, experience building and leading the Company, extensive banking experience in the Midwest, and his first-hand knowledge of our lines of business and corporate strategy provide our Board of Directors a valuable resource for understanding the day-to-day operations and strategic direction of the Company and the industry.

Carrie L. Boer. Mrs. Boer is a director of the Company and our Bank. Since 2000, Mrs. Boer has served as the director of Investments for Cook Holdings, a family investment office, and as a director and the Treasurer of the Peter C. & Emajean Cook Foundation, a family charitable foundation. Under direction from the Peter C. & Emajean Cook Foundation’s board of directors, Mrs. Boer is responsible for oversight of investment and philanthropic activity. Previously, Mrs. Boer was an auditor for BDO and held various positions with Mazda Great Lakes, including VP of Finance. Mrs. Boer received her bachelor’s degree in Accounting from Michigan State University in 1982, and earned her Certified Public Accountant credential in 1985. Mrs. Boer’s extensive accounting experience coupled with her investment management expertise and financial acumen enhances our Board of Directors’ knowledge in these areas.

Robert W. De Vlieger II. Mr. De Vlieger II is a director of the Company and our Bank. Mr. De Vlieger II is also the president of Bond Corporation, a consumer mortgage financing and general management firm, where he has been employed since 1993. Mr. De Vlieger II was previously employed with Manufacturers Hanover Bank, Beneficial Finance Corporation, and GE Capital Corporation. Mr. De Vlieger II is also presently on the board of Advantage Leasing Corporation, which leases commercial equipment nationwide. Mr. De Vlieger II holds a double major with a liberal arts degree from Hope College in Mathematics and Business Administration. Mr. De Vlieger II’s extensive management and oversight experience and expertise in consumer mortgage financing, commercial equipment leasing and his background in the markets in which we serve provides our Board of Directors with significant insight.

R. Jeffery Dean. Mr. Dean is a director of the Company and our Bank. Mr. Dean is the President and Owner of Tallgrass Properties, a commercial real estate development company, and JCMD Leasing, an industrial equipment leasing company, a position he has held since 2010 and 1994, respectively. He was formerly a President of Evolution Insurance Company, and Chief Executive Officer and President of The Armada Group in Grand Rapids, Michigan. Prior to Armada, Mr. Dean held positions with General Electric, Price Waterhouse, and BDO Seidman. He is a Certified Public Accountant, with Certified Management Accountant and Certified in Production and Inventory Management certificates, and graduated with Bachelor of Science degree in finance from Michigan State University. Mr. Dean’s commercial real estate expertise and considerable experience in accounting provides the Board of Directors with a meaningful perspective and valuable insight.

Bruce L. Edger. Mr. Edger is a director of the Company and our Bank. Since 1990, he has served as a Registered Securities Principal with Beaconsfield Financial Services, Inc., a full service brokerage firm, and an Investment Advisor Representative with Summit Advisors, LLC, a portfolio management company for individuals and small businesses. In this capacity, Mr. Edger provides investment advisory and wealth management services for clients, including a number of stockholders of Northpointe Bancshares. Previously, Mr. Edger was the Chief Executive Officer and co-owner of Pension Systems, LLC, a firm providing retirement plan services to employers. Mr. Edger served as Controller and General Manager of Reclamet, Incorporated and prior to that, served as a Loan Officer with Hastings City Bank. Mr. Edger holds a bachelor’s degree in Business from Davenport College. Mr. Edger offers expertise in financial services and a unique understanding of our markets, operations and competition, all of which provides our Board of Directors with a valuable resource and perspective.

John M. Eggemeyer III. Mr. Eggemeyer is a director of the Company and our Bank. Mr. Eggemeyer is a Founder and Managing Partner of Castle Creek Capital LLC, which has been an investor in the banking industry since 1990. Mr. Eggemeyer has over 40 years of experience in the banking industry. In 2006, the American Banker honored Mr. Eggemeyer as “Community Banker of the Year” for his success as a builder of community banking companies. Prior to founding Castle Creek, Mr. Eggemeyer spent nearly 20 years as a senior executive with some of the largest banking organizations in the U.S. with responsibilities across a broad spectrum of banking activities. Mr. Eggemeyer served on the board of directors of Pacwest Bancorp, a public company that owns Pacific Western Bank, from 2000 until 2023 and The Bancorp, Inc., a public company and parent company of The Bancorp Bank, from 2016 to 2024. Mr. Eggemeyer serves on the board of Primis Financial Corp., a public company and parent company of Primis Bank, where he serves as chairman of the enterprise risk committee. In addition, Mr. Eggemeyer serves on the board of Banc of California, Inc., a public company and parent company of Banc of California, where he serves as chair of the board and is a member of the

7

Compensation, Nominating and Corporate Governance Committee and the Finance Committee. Mr. Eggemeyer holds a Bachelor of Science degree from Northwestern University and a Master of Business Administration from the University of Chicago. With his wide-ranging professional and investing background in the banking industry, Mr. Eggemeyer brings a wealth of business and management experience to our Board of Directors.

David S. Hooker. Mr. Hooker is a director of the Company and our Bank. Mr. Hooker is the Chief Executive Officer and Manager of Greenville Partners, and the Executive Manager of Greenville Asset Management, positions he has held since 2023. Greenville Partners and Greenville Asset Management are private investment management firms. Previously he served as President & Chief Executive Officer of Frederik Meijer Gardens & Sculpture Park, a private non-profit Michigan corporation serving the public, from 2008 to 2023. Mr. Hooker is also President and Managing Member of C&H Holdings, a real estate and automotive investment company. From 2004 to 2006, he was a Partner in DaVinci Capital, a private equity capital firm that assisted new, emerging and growing companies secure financing. Mr. Hooker currently serves on the board of Mary Free Bed Rehabilitation Hospital, the Gerald R. Ford Presidential Foundation and Beer City Dog Biscuits. He previously served as a Trustee to Grand Valley State University. Mr. Hooker holds a bachelor’s degree in Economics from Kenyon College and a master’s in business administration degree from the University of Michigan. Mr. Hooker’s extensive experience and leadership, along with his business acumen and management experience qualify him to serve on our Board of Directors.

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE SEVEN DIRECTOR NOMINEES LISTED ABOVE FOR ELECTION AS A DIRECTOR.

8

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS

Corporate Governance Overview

The Board is committed to having sound corporate governance principles, which are essential to running the Company’s business efficiently and maintaining its integrity in the marketplace. The Board understands that corporate governance practices change and evolve over time, and the Board seeks to adopt and use practices that it believes will be of value to the Company’s stockholders and will positively aid in the governance of the Company. The Board will continue to monitor emerging developments in corporate governance and enhance its policies and procedures when required or when the Board determines that it would benefit the Company and its stockholders.

In this section, we describe the roles and responsibilities of our Board and its committees and describe our corporate governance policies, procedures and related documents. The charters of the Audit, Compensation and Corporate Governance and Nominating Committees of our Board of Directors, our Corporate Governance Guidelines and our Code of Business Conduct and Ethics can be accessed electronically at the Company's website, www.northpointe.com, under the “Investor Relations – Governance – Governance Documents” section. We will also provide a copy of the committee charters, our Corporate Governance Guidelines and our Code of Business Conduct and Ethics without charge upon written request sent to Kevin J. Comps, Corporate Secretary at Northpointe Bancshares, Inc., 3333 Deposit Drive Northeast, Grand Rapids, Michigan 49546. Information that is presented or hyperlinked on our website is not incorporated by reference into this proxy statement.

Board Leadership Structure

The Company is committed to strong board leadership. Our governance framework provides the Board with flexibility to select the appropriate leadership structure for the Company. In making leadership structure determinations, the Board considers many factors, including the specific needs of the business and what is in the best interests of the Company’s stockholders. The Boards of directors of the Company and the Bank are comprised of the same individuals. All such meetings are led by our Chairman of the Board, Mr. Charles A. Williams, who is also our Chief Executive Officer. Mr. Williams’ primary duties are to lead our Board of Directors in establishing our overall vision and strategic plan and to lead our management in carrying out that plan. The Board of Directors does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board. The Board endorses the view that one of its primary functions is to protect stockholders’ interests by providing independent oversight of management, including the Chief Executive Officer. However, the Board does not believe that mandating a particular structure, such as designating an independent lead director or having a separate Chairman of the Board and Chief Executive Officer, is necessary to achieve effective oversight. As a result, the Board has not designated an independent lead director nor has it designated a separate Chairman of the Board and Chief Executive Officer. Six of the Board’s seven directors have been determined by the Board to be independent under the listing standards of the New York Stock Exchange ("NYSE"). All directors, including the Chairman of the Board, are bound by fiduciary obligations imposed by law, to serve the best interests of the stockholders. Accordingly, separating the offices of Chairman of the Board and Chief Executive Officer would not serve to materially enhance or diminish the fiduciary duties of any director.

From time to time, the board leadership structure will be re-evaluated to ensure that it continues to be the most effective approach in serving the Company’s goals. In addition, to further strengthen the oversight of the full Board, our independent directors often hold executive sessions at which only independent directors are present.

Director Independence

The NYSE listing standards provide that a director does not qualify as independent unless the Board of Directors affirmatively determines that the director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company). The Board of Directors has established categorical standards of independence to assist it in determining director independence which conform to the independence requirements in the NYSE listing standards. The categorical standards of independence are incorporated within our Corporate Governance Guidelines.

9

The Board of Directors has affirmatively determined that a majority of its members are independent as defined by the listing standards of the NYSE and the categorical standards of independence set by the Board. The Board has determined that, as of January 1, 2025, the following six directors are independent: Carrie L. Boer, R. Jeffery Dean, Robert W. De Vlieger II, Bruce L. Edger, John M. Eggemeyer III, and David S. Hooker. Please see the section entitled “Certain Relationships and Related Transactions” for a discussion of certain relationships between the Company and its independent directors. These relationships have been considered by the Board in determining a director’s independence from the Company under the Company’s Corporate Governance Guidelines and the NYSE listing standards and were determined to be immaterial.

Board Role in Risk Oversight

The Board has the ultimate authority and responsibility for overseeing the Company’s risk management. The Board does not view risk in isolation and considers risk in virtually every business decision and as part of the Company’s overall business strategy. The Board monitors, reviews and reacts to material enterprise risks identified by management. The Board receives specific reports from executive management on financial, credit, liquidity, interest rate, capital, operational, legal compliance and reputation risks and the degree of exposure to those risks. The Board helps ensure that management is properly focused on risk by, among other things, reviewing and discussing the performance of senior management and business line leaders. Board committees have responsibility for risk oversight in specific areas. The Audit Committee oversees risks related to financial reporting, internal controls over financial reporting, valuation of investment securities, internal and independent audit functions, capital adequacy, legal matters, tax matters, credit matters, and reputational risks relating to these areas. The Compensation Committee oversees risks related to incentive compensation, executive and director compensation, executive succession planning, talent retention, human capital, and reputational risks relating to these areas. The Corporate Governance and Nominating Committee is tasked with overseeing the nomination and evaluation of the Board and our corporate governance principles. In addition, the Corporate Governance and Nominating Committee oversees ESG-related risks and corporate governance-related risks, such as board composition and effectiveness, board succession planning, corporate governance policies and reputational risks relating to these areas.

As part of the risk governance process, the head of the Company’s enterprise risk management function also provides a quarterly report and updates on risk management to the Board of Directors. The Company believes that its enterprise risk framework, including the active engagement of management with the Board in the risk oversight function, supports the risk oversight function of the Board.

Cybersecurity and Information Security Risk Oversight

The Board recognizes the importance of maintaining the trust and confidence of our customers, clients, and employees, and devotes significant time and attention to oversight of cybersecurity and information security risk. In particular, our Board and management each receive regular reporting on cybersecurity and information security risk and discusses cybersecurity and information security risks with both the Information Technology Steering Committee and Chief Information Security Officer as needed. Our Information Technology Steering Committee and Chief Information Security Officer also reviews and approves our cybersecurity and information security program as well as steps taken by management to understand and mitigate such risks. For more information on our cybersecurity risk management, strategy, and governance, please see “Part I - Item 1C. Cybersecurity” in the 2024 Annual Report.

Non-Management Executive Sessions

In order to give a significant voice to our non-management directors, our Corporate Governance Guidelines provide for executive sessions of our non-management and independent directors. Our Board believes this is an important governance practice that enables the Board to discuss matters without management present. Our non-management directors are given the opportunity to meet in an executive session following each regularly scheduled Board meeting and Audit Committee meeting. Our independent directors are given the opportunity to meet separately from the other directors in regularly scheduled executive sessions at least once a year, and at such times as may be deemed appropriate by the Company's independent directors. The longest-serving independent/non-management director on the Board presides at these executive

10

sessions, and sets the agenda for such executive sessions. Any independent director may call an executive session of independent directors at any time.

Board and Committee Self-Evaluation

The Board’s annual self-evaluation is a key component of its director nomination process and succession planning. In fact, the Corporate Governance and Nominating Committee uses the input from these self-evaluations to recommend changes to the Company’s corporate governance practices and areas of focus for the following year and to plan for an orderly succession of the Board and its committees. The Board values the contributions of directors who have developed extensive experience and insight into the Company during the course of their service on the Board and as such, the Board does not believe arbitrary term limits on directors’ service are appropriate. At the same time, the Board recognizes the importance of Board refreshment to help ensure an appropriate balance of experience and perspectives on the Board.

Board Meetings and Attendance

The Company's Board of Directors had twelve meetings in 2024. All Board meetings are led by our Chairman of the Board and directors are expected to attend all Board meetings and all meetings of committees on which they serve. During 2024, each director attended at least 75% of the aggregate number of meetings of the Board and Board committees on which he or she served. Although the Company has no formal policy with respect to Board members’ attendance at its Annual Meetings, it is customary for all Board members to attend the Annual Meeting. All of the Company’s then-current directors attended the Company’s 2024 annual meeting of stockholders.

Committees of the Board

Our Board of Directors currently has three principal standing committees – an Audit Committee, a Compensation Committee and a Corporate Governance and Nominating Committee. Each committee has a written charter adopted by the Board that complies with the applicable listing standards of the NYSE pertaining to corporate governance. Copies of the committee charters are available at the Company's website, www.northpointe.com, under the “Investor Relations – Governance – Governance Documents” section. The Board has determined that each member of the Audit, Compensation and Corporate Governance and Nominating Committees is an independent director as defined by the listing standards of the NYSE and our Corporate Governance Guidelines. The following table shows the membership and leadership of the various committees as of the date of this proxy statement.

Director |

Independent

Director(1)

|

Audit

Committee

|

Compensation

Committee

|

Corporate Governance and Nominating

Committee

|

||||||||||

| Charles A. Williams | No |

|||||||||||||

| Carrie L. Boer | Yes |

Member |

Member |

Member |

||||||||||

| Robert W. De Vlieger II | Yes |

Member |

Member |

|||||||||||

| R. Jeffery Dean | Yes |

Chair |

Member |

Member |

||||||||||

| Bruce L. Edger | Yes |

Chair |

Chair |

|||||||||||

| John M. Eggemeyer III | Yes |

Member |

Member |

Member |

||||||||||

| David S. Hooker | Yes |

Member |

Member |

|||||||||||

(1)Independent as that term is defined in NYSE Listing Rules and SEC rules and regulations for service on the Board of Directors and each committee on which the director serves. In making this determination, the Company considered all ordinary course loan and other business transactions between the director and the Bank.

11

Audit Committee

The Audit Committee met 12 times in 2024. The composition of the Audit Committee was adjusted in early 2025 following the Company's February 2025 Initial Public Offering. The Audit Committee assists the Board in fulfilling its responsibilities with respect to accounting, auditing, financial reporting, internal control, and legal compliance. Our Board has evaluated the independence of the members of the Audit Committee and has determined that (i) each of the members is independent under the applicable rules of NYSE, (ii) each of the members satisfies the additional independence standards under the SEC rules for Audit Committee service and (iii) each of the members has the ability to read and understand fundamental financial statements. The Board also reviewed which members of the Audit Committee meet the criteria to be considered a financial expert as defined by the SEC rules. Based on its review, the Board determined that R. Jeffery Dean qualifies as an “Audit Committee Financial Expert,” as defined under the applicable rules of the SEC, by reason of his prior job experience.

The Audit Committee oversees management and the independent auditors in the Company's accounting and financial reporting processes and audits of the Company's financial statements. The Audit Committee serves as a focal point for communication among the Board, the independent auditors, the internal auditor and management with regard to accounting, reporting, and internal controls. The responsibilities of the Audit Committee include the following:

•selecting and reviewing the performance of our independent auditors and approving, in advance, all engagements and fee arrangements;

•pre-approving audit, permitted non-audit and tax services to be provided by the Company’s independent auditor;

•reviewing and evaluating our independent auditor’s qualification, performance and independence;

•reviewing actions by management on recommendations of the independent auditors and internal auditors;

•meeting with management, the internal auditors and the independent auditors to review the effectiveness of our system of internal control and internal audit procedures;

•reviewing our annual audited financial statements, quarterly financial statements, earnings releases and reports filed with the SEC;

•reviewing critical accounting policies and practices of the Company;

•reviewing reports of regulatory agencies and monitoring management’s compliance with recommendations contained in those reports; and

•handling such other matters that are specifically delegated to the Audit Committee by our Board from time to time.

Compensation Committee

The Compensation Committee met 2 times in 2024, prior to the Company's February 2025 Initial Public Offering. The Compensation Committee assists the Board of Directors in fulfilling its responsibilities relating to compensation of the Company's executive officers and the Company's compensation and benefit programs and policies. Our Board has determined that each of the members of our Compensation Committee is independent within the meaning of the independent director requirements of NYSE and the SEC. Our Board has also determined that the composition of our Compensation Committee meets the requirements for independence under, and the functioning of our Compensation Committee complies with, the applicable requirements of NYSE and SEC rules and regulations. The members of the Compensation Committee also qualify as “non-employee directors” according to the SEC rules.

12

The Compensation Committee assists the Board in fulfilling its responsibilities relating to the compensation of the Chief Executive Officer and executive officers of the Company. In addition, the Compensation Committee oversees the Company’s executive compensation policies, plans and programs. Our Compensation Committee is responsible for, among other things:

•approving and overseeing the Company’s executive compensation program;

•reviewing and approving annual corporate goals and objectives for the Chief Executive Officer, evaluating the Chief Executive Officer’s performance in light of those goals and objectives, and determining the Chief Executive Officer’s compensation level based on such evaluation;

•approving non-CEO executive compensation, including base salary and short-term and long-term compensation;

•overseeing all compensation and benefit programs in which employees of the Company are eligible to participate;

•reviewing the Company’s incentive compensation arrangements to confirm that incentive pay does not encourage unnecessary risk-taking and reviewing and discussing the relationship between risk management and incentive compensation;

•developing and recommending to the Board compensation for non-employee directors;

•monitoring and reviewing the talent management and succession planning processes for the Chief Executive Officer and the Company’s other key executives;

•providing oversight of the Company’s broader talent management processes and initiatives; and

•assisting the Board in its oversight of all other human capital management strategies, practices, and risks.

The Compensation Committee also has the authority, in its sole discretion, to select, retain and terminate (and obtain the advice of) any compensation adviser, including but not limited to compensation consultants and outside legal counsel, as necessary to assist with the execution of its duties and responsibilities as set forth in the committee charter, but only after taking into consideration all factors relevant to the advisor’s independence from management. The Compensation Committee may also delegate its authority to subcommittees or the committee chair when it deems it appropriate and in the best interests of the Company.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee (i) is or has ever been an employee of ours, (ii) was, during the last completed fiscal year, a participant in any related party transaction requiring disclosure under “Certain Relationships and Related Party Transactions,” except with respects to loans made to such committee members in the ordinary course of business on substantially the same terms as those prevailing at the time for comparable transactions with unrelated parties or (iii) had, during the last completed fiscal year, any other interlocking relationship requiring disclosure under applicable SEC rules.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee met 1 time in 2024, prior to the Company's February 2025 Initial Public Offering. The Corporate Governance and Nominating Committee assists the Board of Directors in fulfilling its responsibilities by providing independent director oversight of nominations for election to the Board of Directors and leadership in the Company's corporate governance. Our Board has determined that each of the members of our Corporate Governance and Nominating Committee is independent within the meaning of the independent director requirements of NYSE.

13

The primary functions of the Corporate Governance and Nominating Committee include:

•identifying qualified individuals to become Board members;

•recommending to the Board the director nominees for each annual meeting of stockholders and director nominees to be elected by the Board to fill interim director vacancies;

•recommending to the Board the leadership structure of the Board and the composition and leadership of Board committees;

•overseeing the annual review and evaluation of the performance of the Board and its committees;

•developing and recommending to the Board updates to our corporate governance documents;

•reviewing and assessing stockholders’ feedback related to our governance practices and stockholder engagement process; and

•overseeing the Company’s strategy, initiatives, and policies related to corporate responsibility.

Director Qualifications

The Company’s Corporate Governance Guidelines contain Board membership criteria considered by the Corporate Governance and Nominating Committee in recommending nominees for a position on the Company’s Board. The Committee believes that, at a minimum, a director candidate must possess personal and professional integrity, sound judgment, and forthrightness. A director candidate must also have sufficient time and energy to devote to the affairs of the Company and must be free from conflicts of interest with the Company. The Committee also considers the following criteria when reviewing director candidates and existing directors:

•Whether the director/potential director has the financial acumen or other professional, educational, or business experience relevant to an understanding of the Company’s business;

•Whether the director/potential director assists in achieving a mix of Board members that represents a diversity of background, perspective and experience, including with respect to age, gender, race, place of residence and specialized experience;

•Whether the director/potential director meets the independence requirements of the listing standards of the NYSE and the Board’s director independence standards;

•Whether the director/potential director would be considered a “financial expert” or “financially literate” as defined in the listing standards of the NYSE or applicable law; and

•Whether the director/potential director, by virtue of particular technical expertise, experience, or specialized skill relevant to the Company’s current or future business, will add specific value as a Board member.

The Corporate Governance and Nominating Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. In addition to the criteria set forth above, the Corporate Governance and Nominating Committee considers how the skills and attributes of each individual candidate or incumbent director work together to create a board that is collegial, engaged, and effective in performing its duties. Although the Board does not have a formal policy on diversity, the Board and the Corporate Governance and Nominating Committee believe that the background and qualifications of the directors, considered as a group, should provide a significant mix of experience, knowledge, and abilities that will contribute to Board diversity and allow the Board to effectively fulfill its responsibilities.

14

Director Nominees

Our Bylaws provide that nominations of persons for election to the Board may be made by or at the direction of our Board or by any stockholder entitled to vote for the election of directors at the Annual Meeting who complies with certain procedures in our Bylaws. The Corporate Governance and Nominating Committee utilizes a variety of methods for identifying and evaluating nominees for director and regularly assesses the appropriate size of our Board, and whether any vacancies on our Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Committee considers various potential candidates for director.

Candidates may come to the attention of the Corporate Governance and Nominating Committee through current Board members, professional search firms, stockholders or other persons. These candidates are evaluated at regular or special meetings of the Corporate Governance and Nominating Committee and may be considered at any point during the year. The Corporate Governance and Nominating Committee will consider director candidates recommended by stockholders in the same manner as it considers candidates recommended by others, provided that such candidates are nominated in accordance with the applicable provisions of our Bylaws. Because of this, there is no specific policy regarding stockholder nominations of potential directors. At present, our Board does not engage any third parties to identify and evaluate potential director candidates.

For further information about stockholder nominees, please see the section entitled “Stockholder Proposals” in this proxy statement.

Stockholder Communication with Directors

The Company provides a process for stockholders to send communications to the Board of Directors. Such communications should be directed to Kevin J. Comps, Corporate Secretary at Northpointe Bancshares, Inc. 3333 Deposit Drive Northeast, Grand Rapids, Michigan 49546. The Corporate Secretary is responsible for reviewing all communications addressed to our Board, any committee or any specific director to determine whether such communications require board, committee or personal review, response or action. Generally, the Corporate Secretary will not forward to the Board, any committee or any specific director any communications relating to Company products and services, solicitations, or otherwise improper or irrelevant topics. If, however, the Corporate Secretary determines that a communication relates to corporate governance or otherwise requires review, response or action by the board, any committee or any specific director, then he will promptly send a copy of such communication to each director serving on the board, the applicable committee or the applicable director.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that is designed to ensure that our directors, executive officers, and employees meet the highest standards of ethical conduct. The Code of Business Conduct and Ethics requires that our directors, executive officers, and employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner, and otherwise act with integrity and in the Company’s best interests. Our Code of Business Conduct and Ethics is available on the Company’s website, www.northpointe.com, under the “Investor Relations – Governance – Governance Documents” section.

Corporate Governance Guidelines

We are committed to having sound corporate governance principles, which are essential to running our business efficiently and maintaining our integrity in the marketplace. Our Board has adopted Corporate Governance Guidelines which set forth the framework within which our Board, assisted by its committees, direct the affairs of our Company. In particular, our Corporate Governance Guidelines govern certain activities, including:

•director qualification, independence, and selection, as well as stockholder recommendations for director candidates;

15

•director responsibilities and board committees;

•director meetings;

•management succession and review;

•director evaluations; and

•director access to management and independent advisors.

Insider Trading Policy

The Company has adopted an insider trading policy that prohibits directors, officers, employees or any of their immediate family members from purchasing, selling, or offering to purchase or sell, any Company security while in possession of material nonpublic information about the Company. The policy also prohibits such individuals from communicating that information to any other person without the Company’s authorization. As part of the policy, the Company has instituted blackout periods for directors, officers, and certain other employees, and requires pre-clearance of all transactions in any Company security by such persons. A copy of the Company's Insider Trading Policy has been filed as Exhibit 19 to the 2024 Annual Report.

Corporate Responsibility

The Company’s culture is defined by its corporate values of high standards of soundness, profitability, service, professionalism, integrity, and citizenship. We believe that operating sustainably benefits our many different stakeholders. The following section summarizes some of the Company’s recent accomplishments and philosophies with respect to social responsibility and environmental sustainability.

Social Responsibility

Founder, Chairman and Chief Executive Officer Charles Williams established the ICARE Pledge as the backbone of our culture, which we have implemented and which we believe has helped to deliver scaled and profitable organic growth to our stakeholders, and encouraged both employee and customer retention. “ICARE” is an acronym for our pledge to Innovate, Client Focus, Act with integrity, Real Value and Empower. We innovate to provide superior products and services. We focus on borrowers and treat them like friends and family. We build trusted relationships because we act with integrity. We believe we deliver real value add through our collaborative, high performance culture and we empower every employee to make decisions benefiting borrowers.

We recognize that the work to better understand the needs and interests of all of our constituencies, particularly those individuals, businesses, organizations and communities we serve as clients, is never finished. Rather, this requires a commitment that extends well beyond the present to living our shared values, to better understanding societal needs and the impacts of our actions, and to making continuous improvements in order to deliver our services today better than we did yesterday.

As a service business, our people are paramount to the success of our Company. As such, we are focused on hiring, retaining, developing and nurturing our people in several different ways. Some of those ways are identified below:

•New employee orientation introduces new employees to our history, mission, values and principles, including our ICARE Pledge.

•We provide a competitive compensation and benefits program to help meet the needs of our employees. In addition to salaries, these programs include annual bonus opportunities, a 401(k) plan with an employer matching contribution, healthcare and insurance benefits, flexible spending accounts, paid time off and family leave, a wellness program that includes physical and emotional health, family support, and work and financial guidance

16

and support, and an employee assistance program. Restricted stock awards are also available to certain employees.

•We invest in the growth and development of our employees by providing a multi-dimensional approach to learning that empowers, intellectually grows, and professionally develops our colleagues. In particular, we facilitate the educational and professional development of our employees through support to attend conferences and obtain degrees, licenses and certifications while employed by us, as well as the opportunity to participate in Company-sponsored trainings.

•We conduct talent review and succession planning every year to reaffirm existing, and identify new, high potential, talented and qualified individuals of diverse backgrounds, perspectives, and experiences as we strive to deepen and enhance our leadership bench. In preparation for these reviews we ask our managers and supervisors to consider for their people any upcoming potential career path steps, potential retirements, and those they would classify as top talent or high potential. From there we establish development plans for these individuals.

•We have established various tools and guides to assist our leaders and future leaders. Some of these tools include time management guides, coaching templates, goal setting guides and worksheets, interviewing guides, critical conversation tips, performance improvement plans, and team assimilation guides.

•The Company has developed career paths to serve as a written guide or process to chart a course of career development. This involves understanding what knowledge, skills, personal characteristics and experience are required to progress within certain careers in the Company. Well defined paths exist in the following areas: credit analysis, branch customer service, call center service, mortgage processing, and mortgage underwriting.

The Bank is subject to the Community Reinvestment Act (the “CRA”), under which the appropriate federal banking agency periodically assesses the Bank’s record in meeting the credit needs of the communities it serves, including low and moderate income neighborhoods. The Bank had a rating of “Satisfactory” in its most recent CRA evaluation. The Bank has a designated CRA officer that monitors the Bank’s compliance under this act.

Environmental Sustainability

Our business model of delivering most of our deposit banking solutions virtually naturally limits our environmental footprint as we are able to serve our customers with only one physical branch location. Additionally, a large portion of our workforce are remote employees, limiting the space requirements for backroom operation staff.

As a financial services organization, our direct impact on the environment is relatively low compared to other business sectors. However, we believe we still have a responsibility to use resources wisely. We are committed to continually addressing our environmental impact and taking practical steps to minimize and optimize our use of environmental resources, particularly in the buildings that we own.

17

EXECUTIVE OFFICERS

The biographical information set forth below outlines the background and experience of the Company’s executive officers who do not also serve on the Company’s Board. No executive officer has any family relationship, as defined in Item 401 of Regulation S- K, with any other executive officer or any of our current directors. There are no arrangements or understandings between any of the officers and any other person pursuant to which he or she was selected as an officer.

| Name | Age | Position | ||||||||||||

| Kevin J. Comps | 43 | President and Secretary | ||||||||||||

| Brad T. Howes | 45 | Executive Vice President, Chief Financial Officer | ||||||||||||

| David J. Christel | 59 | President of MPP | ||||||||||||

| Amy M. Butler | 48 | Executive Vice President, National Sales | ||||||||||||

Kevin J. Comps. Mr. Comps is the President and Secretary of Northpointe Bancshares, Inc. and our Bank. Mr. Comps joined our Bank in 2012 for three years and again in 2017, and is responsible for overseeing Residential Lending, Deposit Banking, Loan Servicing, Information Technology, Compliance, Legal, Administration, Facilities, and Human Resources. Mr. Comps has over 20 years of experience in the financial services industry including various roles in executive management including Director of Finance and Accounting, Controller and Chief Financial Officer. Prior to joining Northpointe Bancshares, Mr. Comps held leadership roles at Capitol National Bank, Flagstar Bank, Michigan Commerce Bank, and Capitol Bancorp Limited. Mr. Comps has a Bachelor of Science degree in Business Administration from the Central Michigan University and also a degree from the Graduate School of Banking at the University of Wisconsin.

Brad T. Howes. Mr. Howes is the Executive Vice President and Chief Financial Officer of Northpointe Bancshares, Inc. and our Bank. Since joining in 2023, Mr. Howes has been responsible for overseeing the finance and accounting functions. Mr. Howes was the Chief Financial Officer at West Shore Bank from 2021 until 2023 and the Senior Finance Manager of Financial Planning & Analysis at TCF Bank from 2019 to 2021. Mr. Howes has over 23 years of experience in the financial services industry, including as the Director of Investor Relations, Senior Finance Manager of Financial Planning & Analysis and Chief Financial Officer. Prior to joining Northpointe, Mr. Howes held leadership roles at Comerica Bank, Flagstar Bank, Umpqua Bank, TCF Bank and West Shore Bank. Mr. Howes has a Bachelor of Science degree in business administration from Central Michigan University and a Juris Doctorate from the University of Detroit Mercy School of Law.

David J. Christel. Mr. Christel is the President of the Bank’s Mortgage Purchase Program (“MPP”). Since joining our Bank in 2010, Mr. Christel has been responsible for overseeing the company’s MPP business. Mr. Christel has over 25 years of mortgage warehouse lending and commercial banking experience. Prior to joining Northpointe Bank, Mr. Christel served as president of NattyMac, a nationwide warehouse lender from 2004 to 2010. Mr. Christel has also held Senior Level Management positions with Citigroup from 2000 to 2004, Republic Bank from 1996 to 2000, and HSBC form 1988 to 1996. Mr. Christel holds a Bachelor of Science degree in business administration from the University of Buffalo.

Amy M. Butler. Ms. Butler joined our Bank in 2020, where she currently serves as the Executive Vice President, National Sales, overseeing the Retail Mortgage Sales efforts. From 2018 until 2020, Ms. Butler was a Builder Services Manager at Ameris Bank and Fidelity Bank (prior to being acquired by Ameris Bank). With over 23 years of experience in the mortgage industry, Ms. Butler has held several leadership positions, including Strategic Accounts Vice President, Regional Vice President of Sales, and Senior Vice President of Sales. Before joining our Bank from Ameris Bank, she held prominent roles at United Guaranty and Arch Mortgage Insurance.

18

EXECUTIVE COMPENSATION AND OTHER MATTERS

As an emerging growth company under the JOBS Act, we have opted to comply with the executive compensation disclosure rules applicable to “smaller reporting companies” as such term is defined in the rules promulgated under the Securities Act of 1933, as amended (the "Securities Act"), which permit us to limit reporting of executive compensation to our principal executive officer, our two other most highly compensated executive officers, who are referred to as our named executive officers, or NEOs. For our fiscal year ended December 31, 2024, our NEOs were Charles A. Williams, our Chief Executive Officer and Chairman, David J. Christel, our President of Warehouse Lending, and Kevin J. Comps, our President.

Summary Compensation Table

The following table sets forth information concerning the compensation paid to our NEOs during our fiscal years ended December 31, 2024 and December 31, 2023.

Name and Principal Position |

Year |

Salary ($) |

Bonus ($)(1)

|

Non-Equity

Incentive Plan

Compensation

($)(2)

|

Stock Awards

($)(3)

|

All Other

Compensation

($)(4)

|

Total ($) |

|||||||||||||||||||||||||||||||||||||

Charles A. Williams |

2024 |

437,749 | 0 | 4,446,255 | 3,710,736 | 374,200 | 8,968,940 | |||||||||||||||||||||||||||||||||||||

Founder, Chief Executive Officer and Chairman |

2023 |

437,749 | 0 | 2,287,957 | 0 | 411,700 | 3,137,406 | |||||||||||||||||||||||||||||||||||||

David J. Christel |

2024 |

175,000 | 0 | 1,453,076 | 3,710,736 | 598,406 | 5,937,218 | |||||||||||||||||||||||||||||||||||||

President of Warehouse Lending |

2023 |

175,000 | 0 | 841,280 | 0 | 411,700 | 1,427,980 | |||||||||||||||||||||||||||||||||||||

Kevin J. Comps |

2024 |

321,249 | 330,000 | 0 |

3,442,896 | 319,270 | 4,413,415 | |||||||||||||||||||||||||||||||||||||

President |

2023 |

292,239 | 200,000 | 0 | 0 | 248,220 | 740,459 | |||||||||||||||||||||||||||||||||||||

_________________________

(1)Reflects a discretionary bonus.

(2)Reflects amounts paid pursuant to the executive’s employment agreement, as described in greater detail below.

(3)Reflects the grant date fair value of the Special RSU Awards (as defined below) computed in accordance with FASB ASC Topic 718. The assumptions used in calculating the grant-date fair value of the Special RSU Awards are set forth in Note 10 to our audited consolidated financial statements included in our 2024 Annual Report.

(4)Reflects for 2024: (a) for each of Messrs. Williams and Christel, the amount realized upon the automatic exercise of their cash-settled stock appreciation rights (“Cash-Settled SARs”) granted in 2019 (the “2024 SAR Payment”); and (b) for Mr. Comps, his 2024 SAR Payment ($318,070) and a mobile device allowance ($1,200).

Compensation Process

Role of the Compensation Committee

The Compensation Committee establishes the overall executive compensation philosophy and program design, sets and approves compensation for our executive officers. The Compensation Committee also approves all equity compensation plans and awards.

19

Role of Management

The Chief Executive Officer and President routinely provide information, advice, and recommendations to the Compensation Committee. The Compensation Committee regularly meets in executive session without executive officers present, and executive officers are not present for discussions regarding his or her specific compensation.

Role of the Independent Compensation Consultant

In December 2024, the Company engaged Frederic W. Cook & Co. (“FW Cook”) as its outside compensation consultant to provide advice related to the Company’s executive compensation program in connection with the initial public offering of our common stock, which was completed in February 2025 (the “IPO”). FW Cook provided advice with respect to the Company’s compensation program, specifically how it compared with those of other similarly situated companies and the appropriateness of the compensation program structure in supporting the Company’s business strategy and human resources objectives All services performed for us by FW Cook during 2024 were related to executive compensation.

Material Components of Compensation Program

Annual Bonus

Pursuant to the terms of Mr. Williams’ employment agreement, as described in greater detail below, he is entitled to receive incentive compensation equal to 10% of the net, after-tax (but prior to any accrual for his incentive compensation) consolidated income of the Company for each calendar quarter. The incentive compensation for each quarter, if any, shall be paid in cash on the next regularly-scheduled payroll date following the Company's determination of the amount of any such incentive compensation. Notwithstanding the foregoing, as of each such payment date, if either (a) the Bank did not receive a composite rating of at least “3” or better in each of its most recent safety/soundness and compliance exams or (b) either the Company or the Bank has not paid in full all accrued interest on any outstanding indebtedness (including subordinated debentures) and accrued dividends on any outstanding securities (including trust preferred securities) that are due and payable on or before such payment date, then the installment payment otherwise payable on such date will not be paid and Mr. Williams’ rights to such amount will be forfeited.