EX-99.2

Published on January 20, 2026

January 21, 2026 Fourth Quarter 2025 Earnings Call Presentation

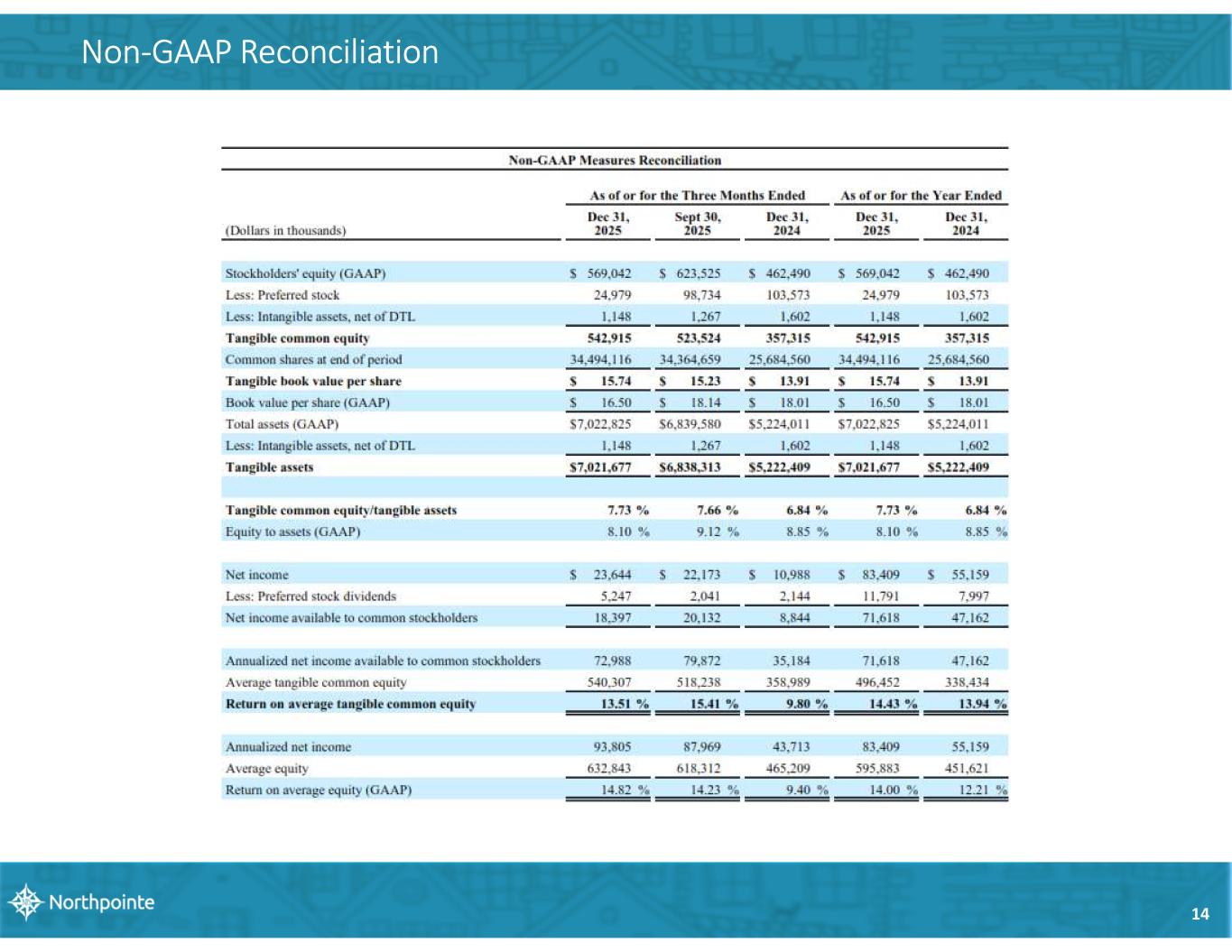

Disclaimer Forward-Looking Statements Statements in this presentation regarding future events and our expectations and beliefs about our future financial performance and financial condition, as well as trends in our business and markets, constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are not historical in nature and may be identified by references to a future period or periods by the use of the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “project,” “outlook,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” The forward-looking statements in this presentation should not be relied on because they are based on current information and on assumptions that we make about future events and circumstances that are subject to a number of known and unknown risks and uncertainties that are often difficult to predict and beyond our control. As a result of those risks and uncertainties, and other factors, our actual financial results in the future could differ, possibly materially, from those expressed in or implied by the forward-looking statements contained in this presentation and could cause us to make changes to our future plans. Factors that might cause such differences include, but are not limited to: the impact of current and future economic conditions, particularly those affecting the financial services industry, including the effects of declines in the real estate market, tariffs or trade wars (including reduced consumer spending, lower economic growth or recession, reduced demand for U.S. exports, disruptions to supply chains, and decreased demand for other banking products and services), high unemployment rates, inflationary pressures, increasing insurance costs, elevated interest rates, including the impact of changes in interest rates on our financial projections, models and guidance and slowdowns in economic growth, as well as the financial stress on borrowers as a result of the foregoing; uncertain duration of trade conflicts; potential impacts of adverse developments in the banking and mortgage industries, including impacts on deposits, liquidity and the regulatory rules and regulations; risks arising from media coverage of the banking and mortgage industries; risks arising from perceived instability in the banking and mortgage sectors; changes in the interest rate environment, including changes to the federal funds rate, which could have an adverse effect on the Company’s profitability; changes in prices, values and sales volumes of residential real estate; developments in our mortgage banking business, including loan modifications, general demand, and the effects of judicial or regulatory requirements or guidance; competition in our markets that may result in increased funding costs or reduced earning assets yields, thus reducing margins and net interest income; legislation or regulatory changes which could adversely affect the ability of the consolidated Company to conduct business combinations or new operations; changes in tax laws; significant turbulence or a disruption in the capital or financial markets and the effect of a fall in stock market prices on our investment securities; the ability to keep pace with technological changes, including changes regarding maintaining cybersecurity and the impact of generative artificial intelligence; increased competition in the financial services industry, particularly from regional and national institutions; the impact of a failure in, or breach of, the Company's operational or security systems or infrastructure, or those of third parties with whom the Company does business, including as a result of cyber-attacks or an increase in the incidence or severity of fraud, illegal payments, security breaches or other illegal acts impacting the Company or the Company's customers; the effects of war or other conflicts; and adverse results from current or future litigation, regulatory examinations or other legal and/or regulatory actions, including as a result of the Company’s participation in and execution of government programs, and legislative, regulatory or supervisory actions related to so-called “de-banking,” including any new prohibitions, requirements or enforcement priorities that could affect customer relationships, compliance obligations, or operational practices. Therefore, the Company can give no assurance that the results contemplated in the forward-looking statements will be realized. Additional information regarding these and other risks and uncertainties to which our business and future financial performance are subject is contained in the sections titled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q on file with the U.S. Securities and Exchange Commission (the “SEC”), and in other documents that we file with the SEC from time to time, which are available on the SEC’s website, http://www.sec.gov. Due to these and other possible uncertainties and risks, readers are cautioned not to place undue reliance on the forward-looking statements contained in this presentation or to make predictions based solely on historical financial performance. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. All forward-looking statements, express or implied, included in this presentation are qualified in their entirety by this cautionary statement. 2 Use of Non-GAAP Financial Measures This presentation contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (“GAAP”) and therefore are considered non-GAAP financial measures. The measures entitled tangible common equity, tangible book value per share, tangible assets, tangible common equity to tangible assets and return on average tangible common equity are not measures recognized under GAAP and therefore are considered non-GAAP financial measures. The most comparable GAAP measures to these measures are stockholders’ equity, book value per share, total assets, equity to assets and return on average equity, respectively. The Company calculates tangible common equity as stockholders' equity less goodwill and intangible assets net of deferred tax liability ("DTL") and preferred stock. The Company calculates tangible book value per share as tangible common equity divided by the number of shares of common stock outstanding at the end of the relevant period. The Company calculates tangible assets as total assets less intangible assets (net of DTL). The Company calculates tangible common equity to tangible assets as tangible common equity divided by tangible assets. The Company calculates return on average tangible common equity as annualized net income available to common stockholders divided by average tangible equity. The most directly comparable GAAP financial measures are outlined in the non-GAAP reconciliation in the Appendix of this slide presentation. The Company believes that non-GAAP financial measures provide useful information to management and investors that is supplementary to its financial condition, results of operations and cash flows computed in accordance with GAAP; however the Company acknowledges that the non-GAAP financial measures have inherent limitations. As such, these disclosures should not be viewed as a substitute for results determined in accordance with GAAP, and these disclosures are not necessarily comparable to non-GAAP financial measures that other companies use.

Agenda 3 Chuck A. Williams Chairman & CEO Kevin J. Comps President Bradley T. Howes Executive Vice President and CFO • Formal Remarks • Chuck Williams, Chairman & CEO • Kevin Comps, President • Bradley Howes, CFO • Question and Answer Session • Closing Remarks

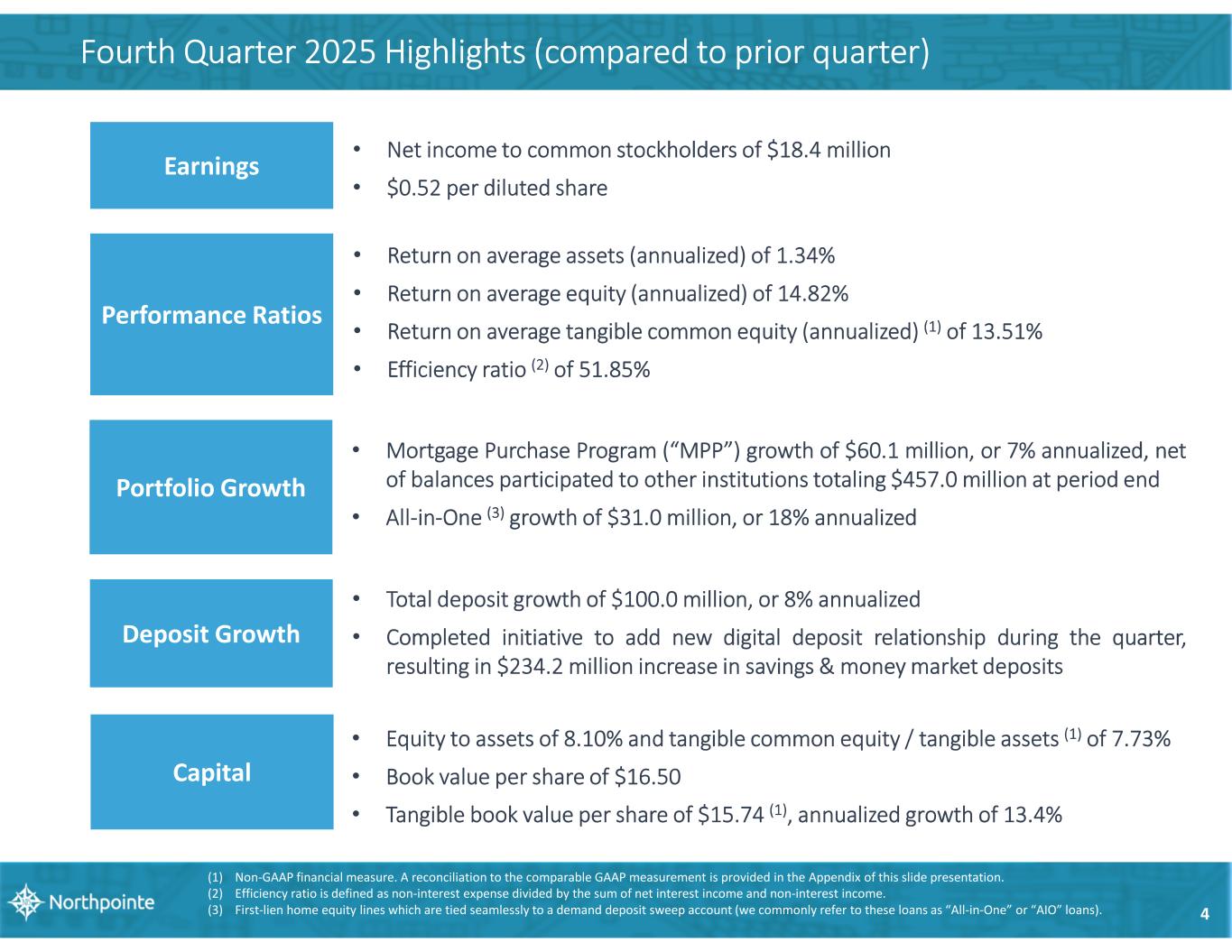

Fourth Quarter 2025 Highlights (compared to prior quarter) 4 Earnings • Net income to common stockholders of $18.4 million • $0.52 per diluted share Performance Ratios • Return on average assets (annualized) of 1.34% • Return on average equity (annualized) of 14.82% • Return on average tangible common equity (annualized) (1) of 13.51% • Efficiency ratio (2) of 51.85% Portfolio Growth • Mortgage Purchase Program (“MPP”) growth of $60.1 million, or 7% annualized, net of balances participated to other institutions totaling $457.0 million at period end • All-in-One (3) growth of $31.0 million, or 18% annualized Deposit Growth • Total deposit growth of $100.0 million, or 8% annualized • Completed initiative to add new digital deposit relationship during the quarter, resulting in $234.2 million increase in savings & money market deposits (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided in the Appendix of this slide presentation. (2) Efficiency ratio is defined as non-interest expense divided by the sum of net interest income and non-interest income. (3) First-lien home equity lines which are tied seamlessly to a demand deposit sweep account (we commonly refer to these loans as “All-in-One” or “AIO” loans). • Equity to assets of 8.10% and tangible common equity / tangible assets (1) of 7.73% • Book value per share of $16.50 • Tangible book value per share of $15.74 (1), annualized growth of 13.4% Capital

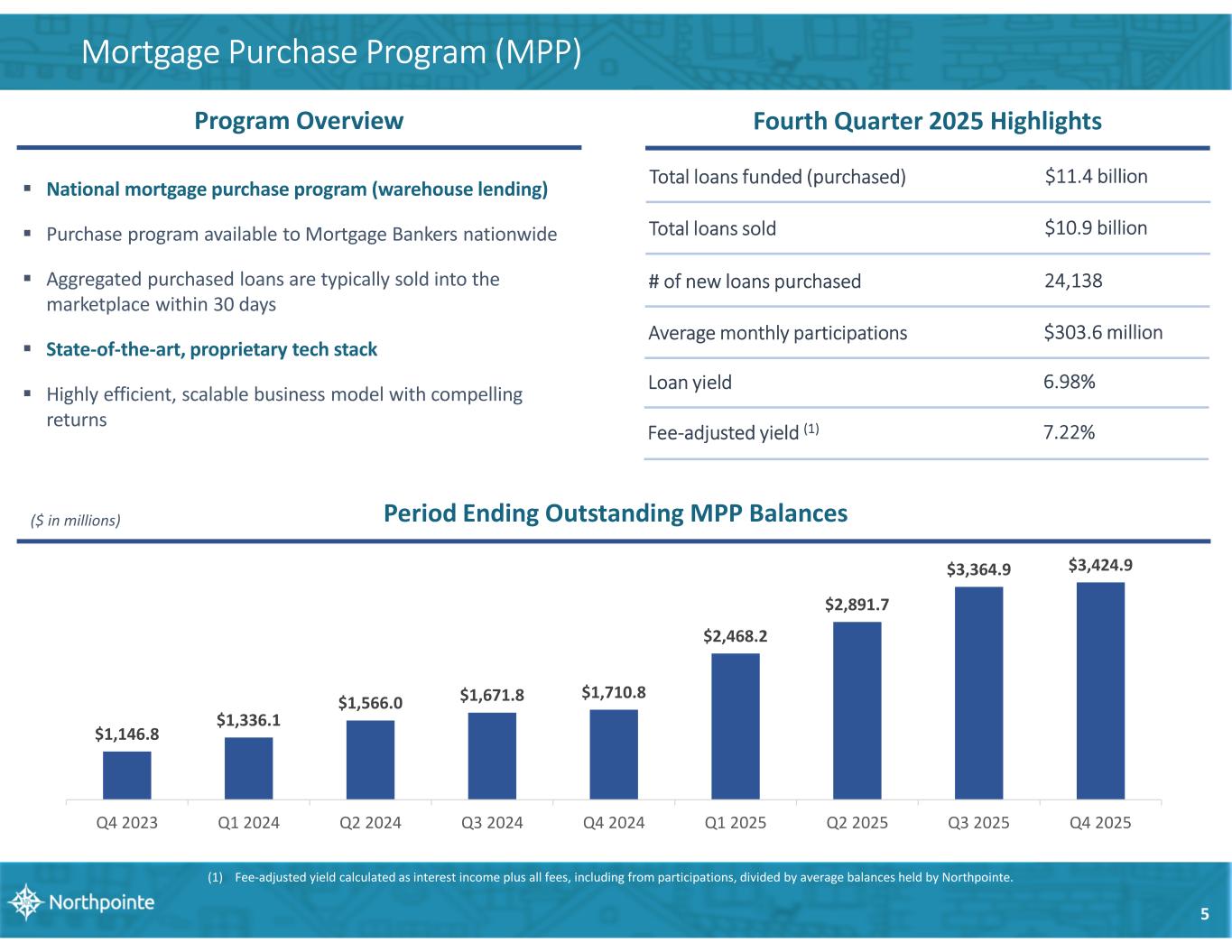

5 Mortgage Purchase Program (MPP) Period Ending Outstanding MPP Balances($ in millions) $1,146.8 $1,336.1 $1,566.0 $1,671.8 $1,710.8 $2,468.2 $2,891.7 $3,364.9 $3,424.9 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Fourth Quarter 2025 Highlights Total loans funded (purchased) $11.4 billion Total loans sold $10.9 billion # of new loans purchased 24,138 Average monthly participations $303.6 million Loan yield 6.98% Fee-adjusted yield (1) 7.22% (1) Fee-adjusted yield calculated as interest income plus all fees, including from participations, divided by average balances held by Northpointe. Program Overview National mortgage purchase program (warehouse lending) Purchase program available to Mortgage Bankers nationwide Aggregated purchased loans are typically sold into the marketplace within 30 days State-of-the-art, proprietary tech stack Highly efficient, scalable business model with compelling returns

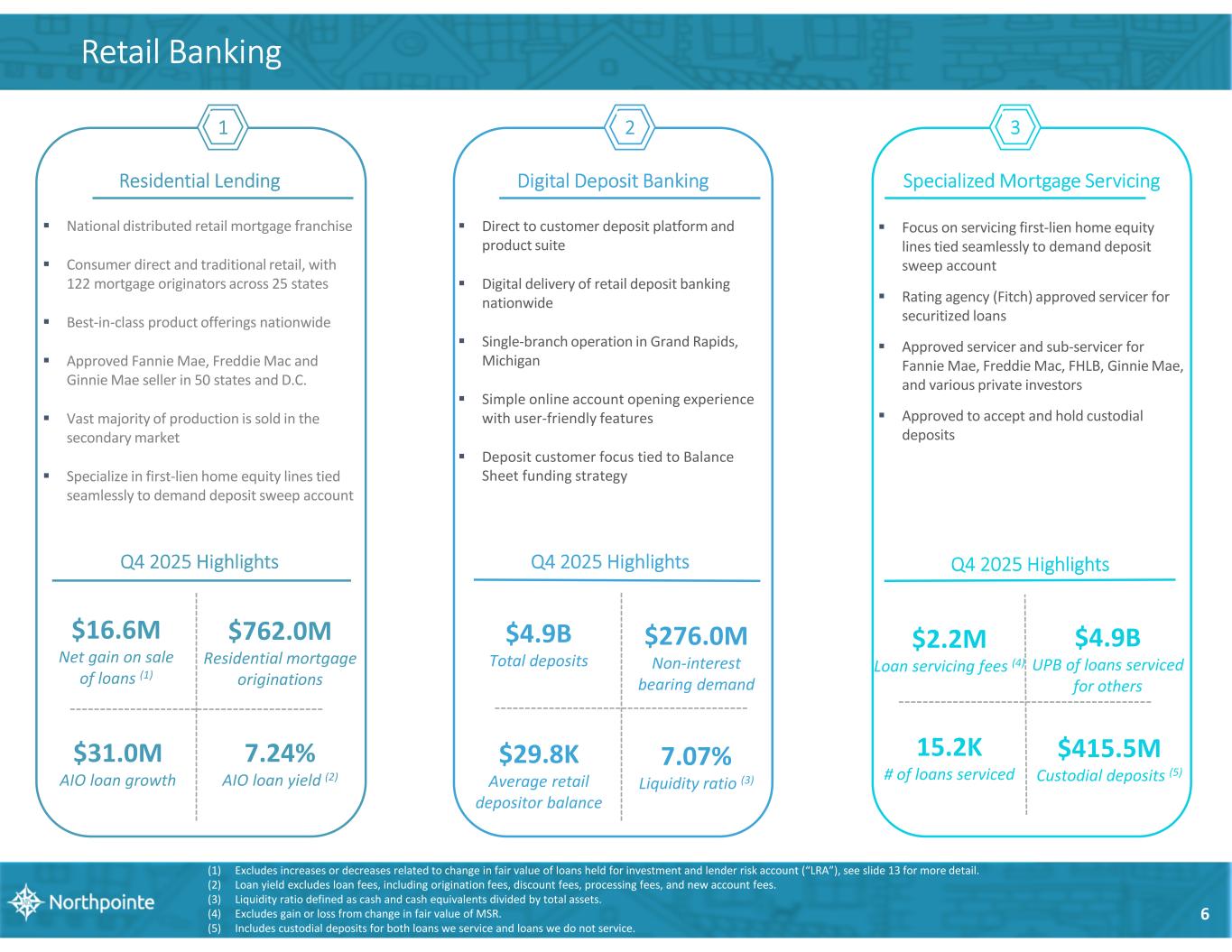

National distributed retail mortgage franchise Consumer direct and traditional retail, with 122 mortgage originators across 25 states Best-in-class product offerings nationwide Approved Fannie Mae, Freddie Mac and Ginnie Mae seller in 50 states and D.C. Vast majority of production is sold in the secondary market Specialize in first-lien home equity lines tied seamlessly to demand deposit sweep account $16.6M Net gain on sale of loans (1) $762.0M Residential mortgage originations 7.24% AIO loan yield (2) Residential Lending Q4 2025 Highlights $31.0M AIO loan growth Focus on servicing first-lien home equity lines tied seamlessly to demand deposit sweep account Rating agency (Fitch) approved servicer for securitized loans Approved servicer and sub-servicer for Fannie Mae, Freddie Mac, FHLB, Ginnie Mae, and various private investors Approved to accept and hold custodial deposits $4.9B UPB of loans serviced for others $2.2M Loan servicing fees (4) Specialized Mortgage Servicing Q4 2025 Highlights Direct to customer deposit platform and product suite Digital delivery of retail deposit banking nationwide Single-branch operation in Grand Rapids, Michigan Simple online account opening experience with user-friendly features Deposit customer focus tied to Balance Sheet funding strategy $4.9B Total deposits $276.0M Non-interest bearing demand Digital Deposit Banking Q4 2025 Highlights $29.8K Average retail depositor balance 7.07% Liquidity ratio (3) 15.2K # of loans serviced 6 Retail Banking 1 2 3 (1) Excludes increases or decreases related to change in fair value of loans held for investment and lender risk account (“LRA”), see slide 13 for more detail. (2) Loan yield excludes loan fees, including origination fees, discount fees, processing fees, and new account fees. (3) Liquidity ratio defined as cash and cash equivalents divided by total assets. (4) Excludes gain or loss from change in fair value of MSR. (5) Includes custodial deposits for both loans we service and loans we do not service. $415.5M Custodial deposits (5)

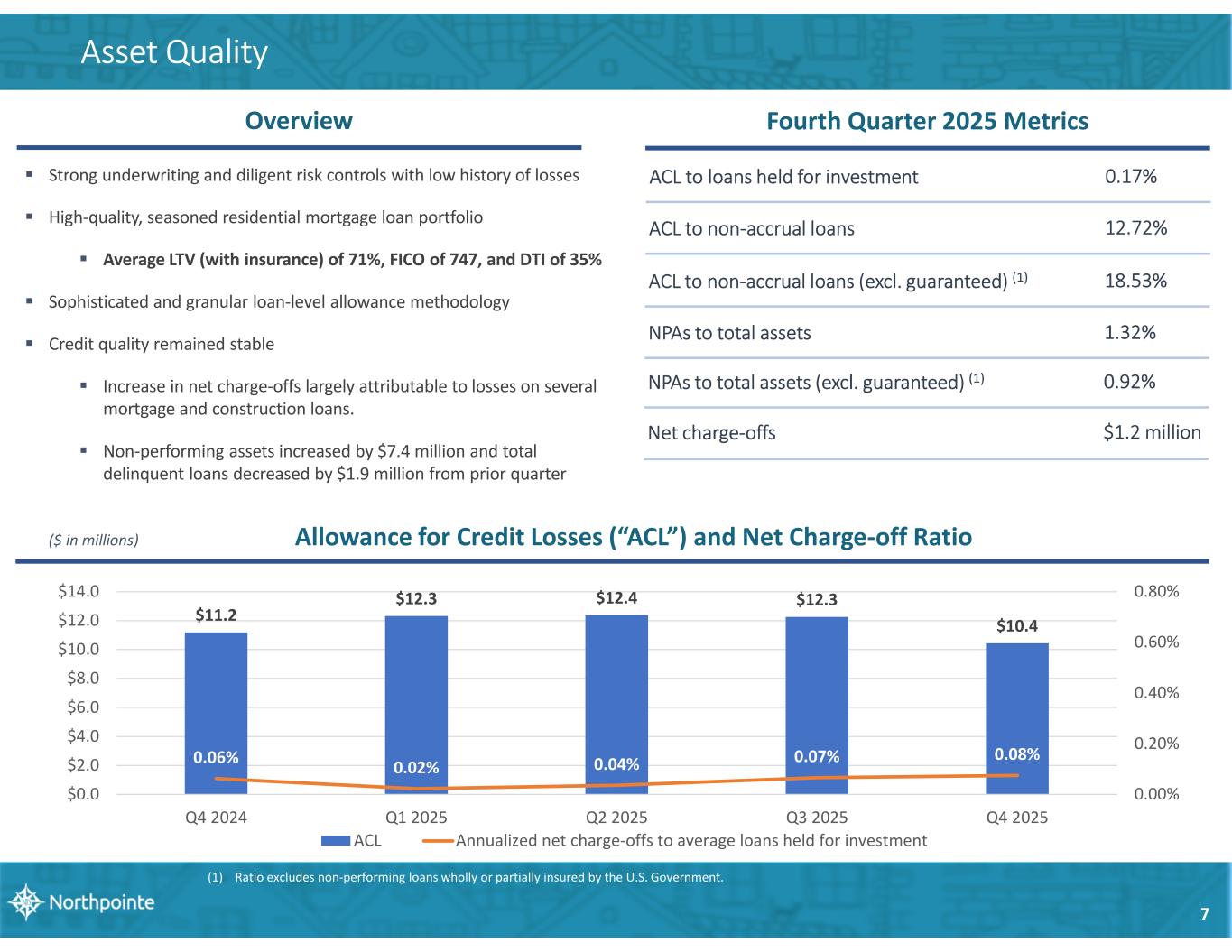

Allowance for Credit Losses (“ACL”) and Net Charge-off Ratio 7 Asset Quality Fourth Quarter 2025 Metrics ACL to loans held for investment 0.17% ACL to non-accrual loans 12.72% ACL to non-accrual loans (excl. guaranteed) (1) 18.53% NPAs to total assets 1.32% NPAs to total assets (excl. guaranteed) (1) 0.92% Net charge-offs $1.2 million ($ in millions) Overview Strong underwriting and diligent risk controls with low history of losses High-quality, seasoned residential mortgage loan portfolio Average LTV (with insurance) of 71%, FICO of 747, and DTI of 35% Sophisticated and granular loan-level allowance methodology Credit quality remained stable Increase in net charge-offs largely attributable to losses on several mortgage and construction loans. Non-performing assets increased by $7.4 million and total delinquent loans decreased by $1.9 million from prior quarter $11.2 $12.3 $12.4 $12.3 $10.4 0.06% 0.02% 0.04% 0.07% 0.08% 0.00% 0.20% 0.40% 0.60% 0.80% $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 ACL Annualized net charge-offs to average loans held for investment (1) Ratio excludes non-performing loans wholly or partially insured by the U.S. Government.

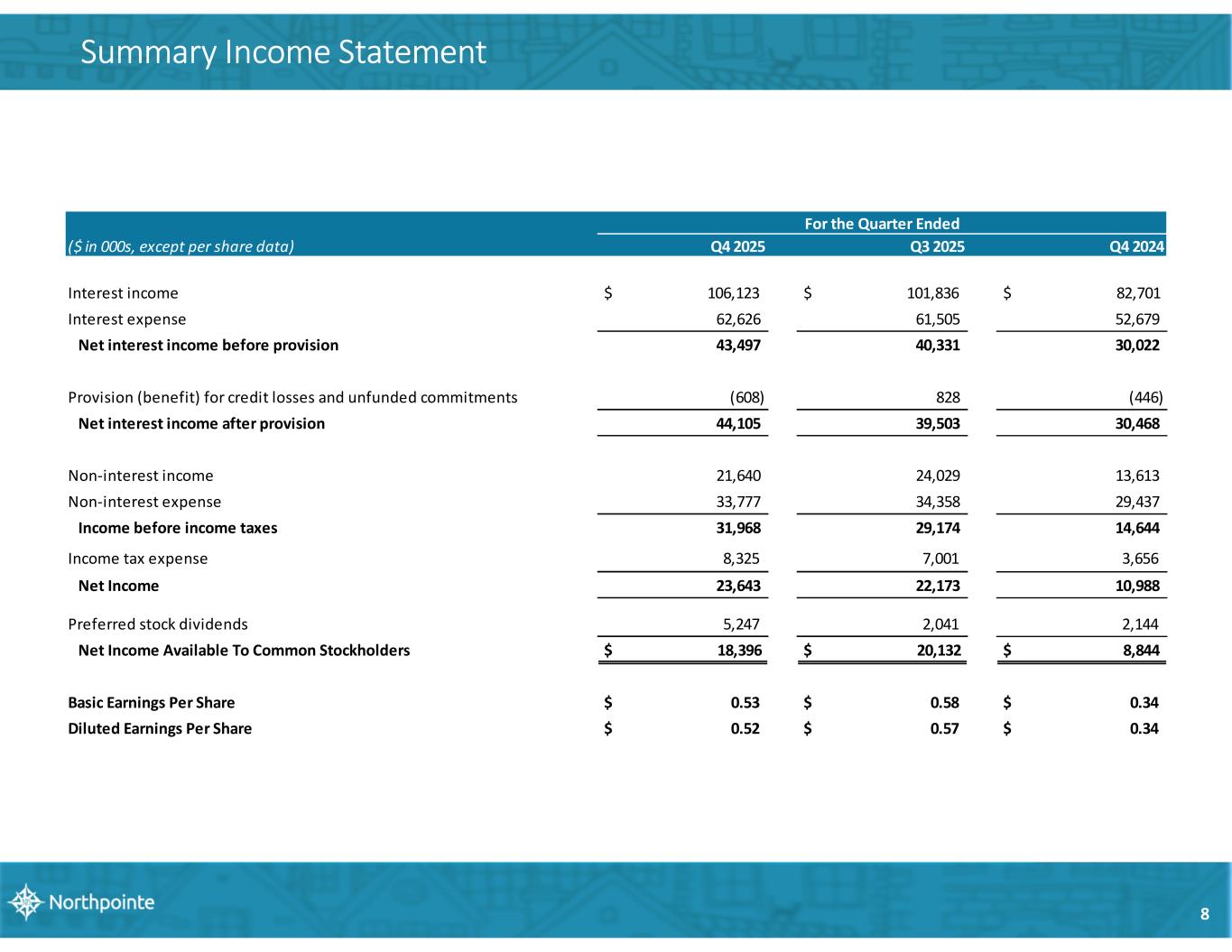

8 Summary Income Statement ($ in 000s, except per share data) Q4 2025 Q3 2025 Q4 2024 Interest income $ 106,123 $ 101,836 $ 82,701 Interest expense 62,626 61,505 52,679 Net interest income before provision 43,497 40,331 30,022 Provision (benefit) for credit losses and unfunded commitments (608) 828 (446) Net interest income after provision 44,105 39,503 30,468 Non-interest income 21,640 24,029 13,613 Non-interest expense 33,777 34,358 29,437 Income before income taxes 31,968 29,174 14,644 Income tax expense 8,325 7,001 3,656 Net Income 23,643 22,173 10,988 Preferred stock dividends 5,247 2,041 2,144 Net Income Available To Common Stockholders $ 18,396 $ 20,132 $ 8,844 Basic Earnings Per Share $ 0.53 $ 0.58 $ 0.34 Diluted Earnings Per Share $ 0.52 $ 0.57 $ 0.34 For the Quarter Ended

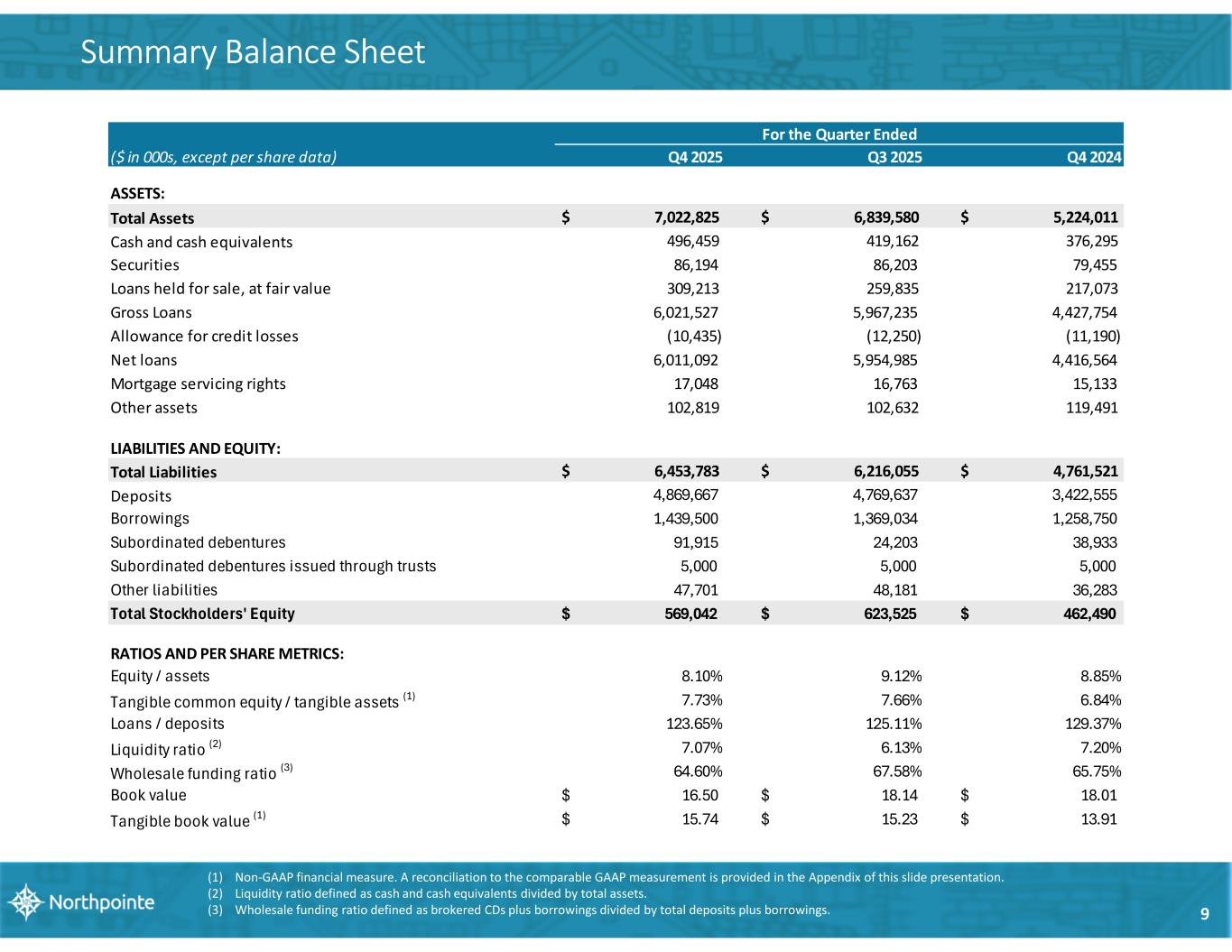

9 Summary Balance Sheet (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided in the Appendix of this slide presentation. (2) Liquidity ratio defined as cash and cash equivalents divided by total assets. (3) Wholesale funding ratio defined as brokered CDs plus borrowings divided by total deposits plus borrowings. ($ in 000s, except per share data) Q4 2025 Q3 2025 Q4 2024 ASSETS: Total Assets $ 7,022,825 $ 6,839,580 $ 5,224,011 Cash and cash equivalents 496,459 419,162 376,295 Securities 86,194 86,203 79,455 Loans held for sale, at fair value 309,213 259,835 217,073 Gross Loans 6,021,527 5,967,235 4,427,754 Allowance for credit losses (10,435) (12,250) (11,190) Net loans 6,011,092 5,954,985 4,416,564 Mortgage servicing rights 17,048 16,763 15,133 Other assets 102,819 102,632 119,491 LIABILITIES AND EQUITY: Total Liabilities $ 6,453,783 $ 6,216,055 $ 4,761,521 Deposits 4,869,667 4,769,637 3,422,555 Borrowings 1,439,500 1,369,034 1,258,750 Subordinated debentures 91,915 24,203 38,933 Subordinated debentures issued through trusts 5,000 5,000 5,000 Other liabilities 47,701 48,181 36,283 Total Stockholders' Equity $ 569,042 $ 623,525 $ 462,490 RATIOS AND PER SHARE METRICS: Equity / assets 8.10% 9.12% 8.85% Tangible common equity / tangible assets (1) 7.73% 7.66% 6.84% Loans / deposits 123.65% 125.11% 129.37% Liquidity ratio (2) 7.07% 6.13% 7.20% Wholesale funding ratio (3) 64.60% 67.58% 65.75% Book value $ 16.50 $ 18.14 $ 18.01 Tangible book value (1) $ 15.74 $ 15.23 $ 13.91 For the Quarter Ended

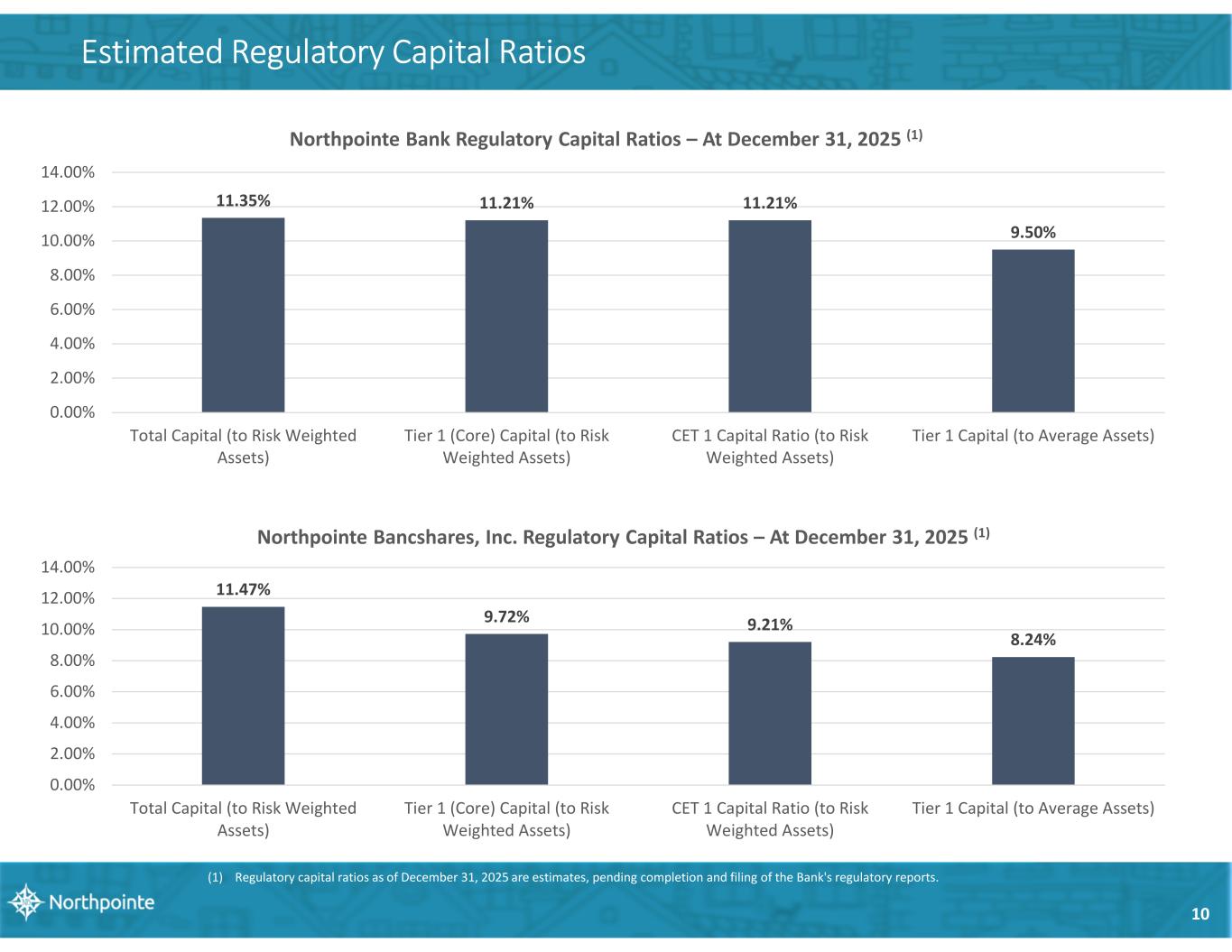

10 Estimated Regulatory Capital Ratios 11.35% 11.21% 11.21% 9.50% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% Total Capital (to Risk Weighted Assets) Tier 1 (Core) Capital (to Risk Weighted Assets) CET 1 Capital Ratio (to Risk Weighted Assets) Tier 1 Capital (to Average Assets) Northpointe Bank Regulatory Capital Ratios – At December 31, 2025 (1) (1) Regulatory capital ratios as of December 31, 2025 are estimates, pending completion and filing of the Bank's regulatory reports. 11.47% 9.72% 9.21% 8.24% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% Total Capital (to Risk Weighted Assets) Tier 1 (Core) Capital (to Risk Weighted Assets) CET 1 Capital Ratio (to Risk Weighted Assets) Tier 1 Capital (to Average Assets) Northpointe Bancshares, Inc. Regulatory Capital Ratios – At December 31, 2025 (1)

APPENDIX

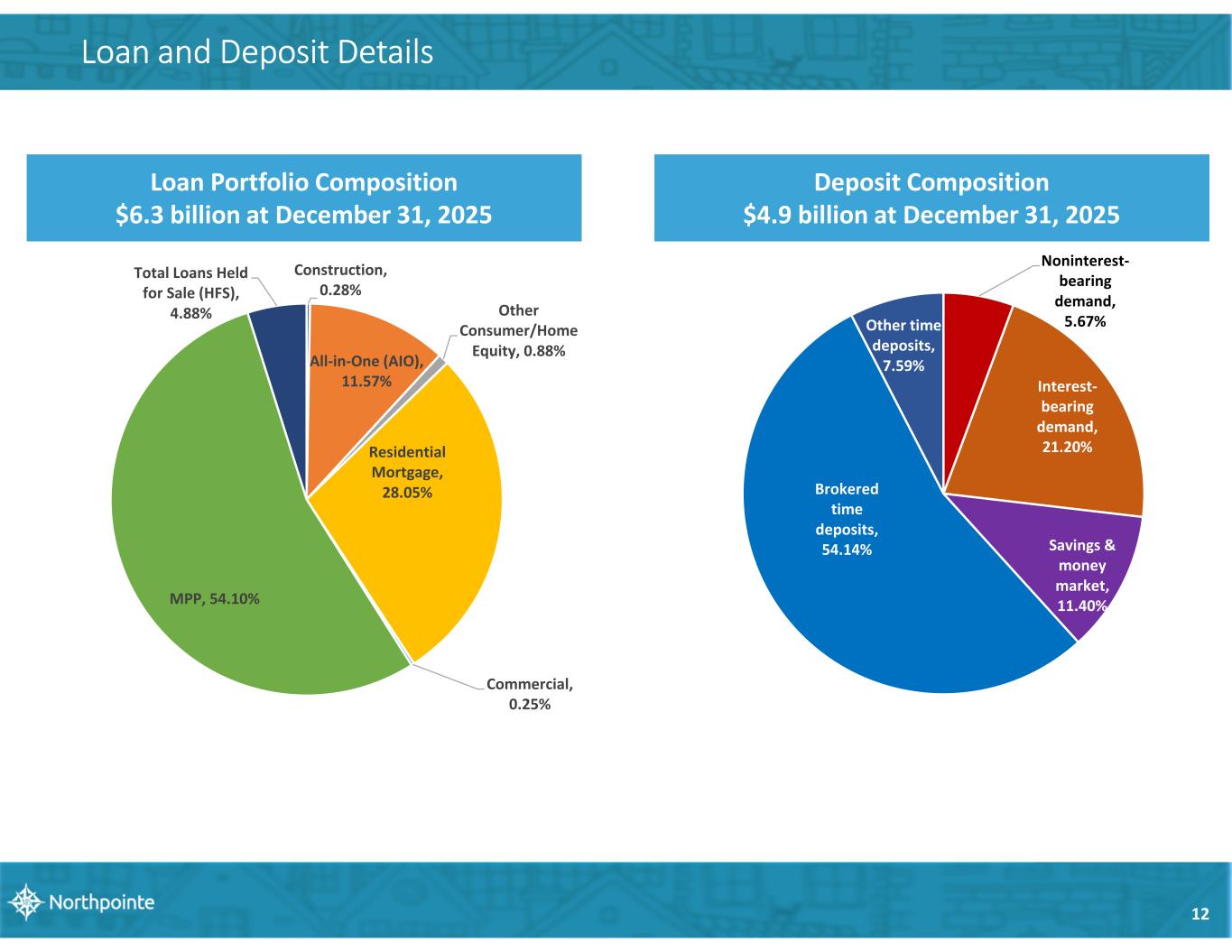

12 Loan and Deposit Details Loan Portfolio Composition $6.3 billion at December 31, 2025 Deposit Composition $4.9 billion at December 31, 2025 Construction, 0.28% All-in-One (AIO), 11.57% Other Consumer/Home Equity, 0.88% Residential Mortgage, 28.05% Commercial, 0.25% MPP, 54.10% Total Loans Held for Sale (HFS), 4.88% Noninterest- bearing demand, 5.67% Interest- bearing demand, 21.20% Savings & money market, 11.40% Brokered time deposits, 54.14% Other time deposits, 7.59%

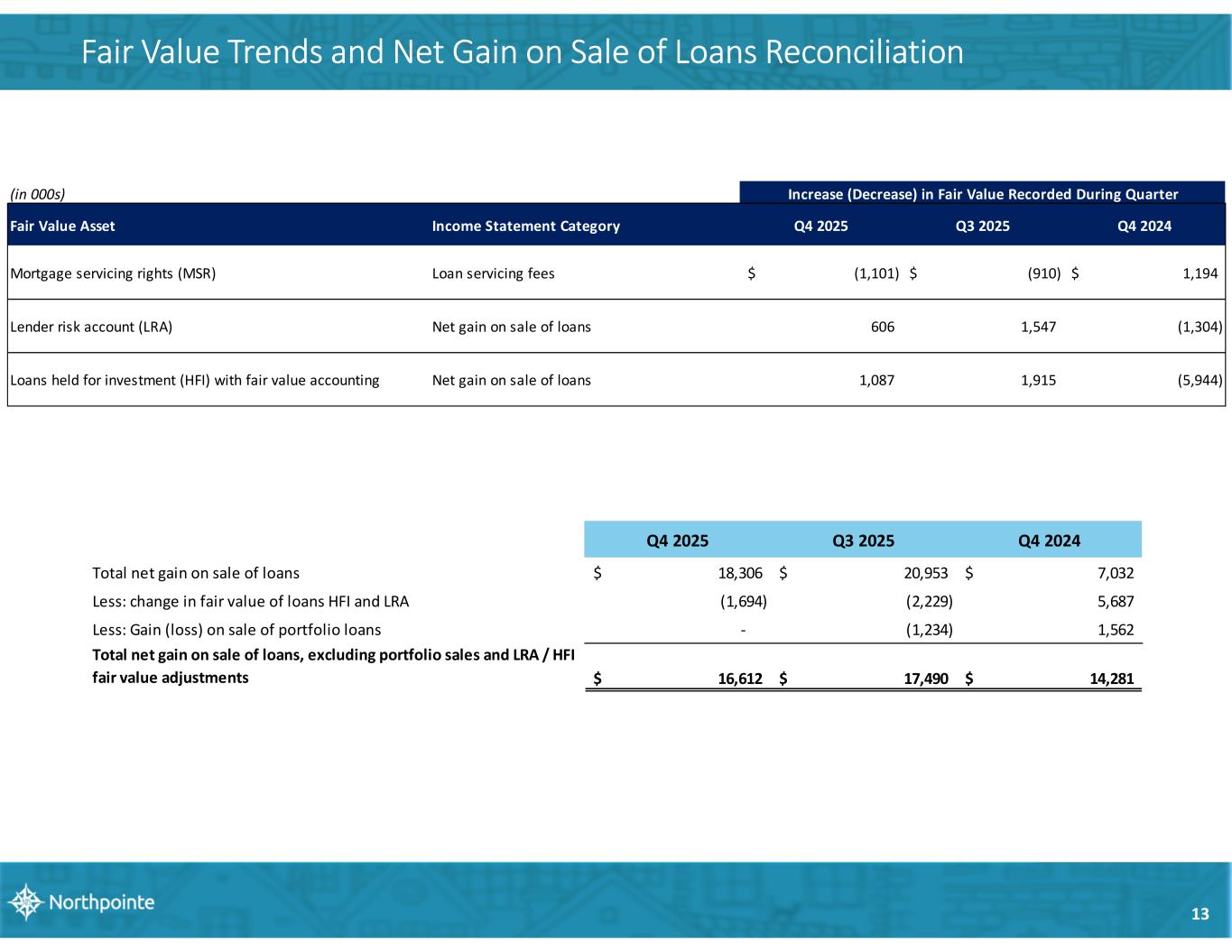

13 Fair Value Trends and Net Gain on Sale of Loans Reconciliation (in 000s) Fair Value Asset Income Statement Category Q4 2025 Q3 2025 Q4 2024 Mortgage servicing rights (MSR) Loan servicing fees (1,101)$ (910)$ 1,194$ Lender risk account (LRA) Net gain on sale of loans 606 1,547 (1,304) Loans held for investment (HFI) with fair value accounting Net gain on sale of loans 1,087 1,915 (5,944) Increase (Decrease) in Fair Value Recorded During Quarter Q4 2025 Q3 2025 Q4 2024 Total net gain on sale of loans 18,306$ 20,953$ 7,032$ Less: change in fair value of loans HFI and LRA (1,694) (2,229) 5,687 Less: Gain (loss) on sale of portfolio loans - (1,234) 1,562 Total net gain on sale of loans, excluding portfolio sales and LRA / HFI fair value adjustments 16,612$ 17,490$ 14,281$

14 Non-GAAP Reconciliation