EX-99.2

Published on April 22, 2025

April 23, 2025 First Quarter 2025 Earnings Call Presentation

Disclaimer Forward-Looking Statements Statements in this presentation regarding future events and our expectations and beliefs about our future financial performance and financial condition, as well as trends in our business and markets, constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are not historical in nature and may be identified by references to a future period or periods by the use of the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “project,” “outlook,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” The forward-looking statements in this presentation should not be relied on because they are based on current information and on assumptions that we make about future events and circumstances that are subject to a number of known and unknown risks and uncertainties that are often difficult to predict and beyond our control. As a result of those risks and uncertainties, and other factors, our actual financial results in the future could differ, possibly materially, from those expressed in or implied by the forward-looking statements contained in this presentation and could cause us to make changes to our future plans. Factors that might cause such differences include, but are not limited to: the impact of current and future economic conditions, particularly those affecting the financial services industry, including the effects of declines in the real estate market, tariffs or trade wars (including reduced consumer spending, lower economic growth or recession, reduced demand for U.S. exports, disruptions to supply chains, and decreased demand for other banking products and services), high unemployment rates, inflationary pressures, increasing insurance costs, elevated interest rates, including the impact of changes in interest rates on our financial projections, models and guidance and slowdowns in economic growth, as well as the financial stress on borrowers as a result of the foregoing; uncertain duration of trade conflicts; potential impacts of adverse developments in the banking and mortgage industries, including impacts on deposits, liquidity and the regulatory rules and regulations; risks arising from media coverage of the banking and mortgage industries; risks arising from perceived instability in the banking and mortgage sectors; changes in the interest rate environment, including changes to the federal funds rate, which could have an adverse effect on the Company’s profitability; changes in prices, values and sales volumes of residential real estate; developments in our mortgage banking business, including loan modifications, general demand, and the effects of judicial or regulatory requirements or guidance; competition in our markets that may result in increased funding costs or reduced earning assets yields, thus reducing margins and net interest income; legislation or regulatory changes which could adversely affect the ability of the consolidated Company to conduct business combinations or new operations; changes in tax laws; significant turbulence or a disruption in the capital or financial markets and the effect of a fall in stock market prices on our investment securities; the ability to keep pace with technological changes, including changes regarding maintaining cybersecurity and the impact of generative artificial intelligence; increased competition in the financial services industry, particularly from regional and national institutions; the impact of a failure in, or breach of, the Company's operational or security systems or infrastructure, or those of third parties with whom the Company does business, including as a result of cyber-attacks or an increase in the incidence or severity of fraud, illegal payments, security breaches or other illegal acts impacting the Company or the Company's customers; the effects of war or other conflicts including the impacts related to or resulting from Russia’s military action in Ukraine or the conflict in Israel and the surrounding region; and adverse results from current or future litigation, regulatory examinations or other legal and/or regulatory actions, including as a result of the Company’s participation in and execution of government programs. Therefore, the Company can give no assurance that the results contemplated in the forward-looking statements will be realized. Additional information regarding these and other risks and uncertainties to which our business and future financial performance are subject is contained in the sections titled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q on file with the U.S. Securities and Exchange Commission (the “SEC”), and in other documents that we file with the SEC from time to time, which are available on the SEC’s website, http://www.sec.gov. In addition, our actual financial results in the future may differ from those currently expected due to additional risks and uncertainties of which we are not currently aware or which we do not currently view as, but in the future may become, material to our business or operating results. Due to these and other possible uncertainties and risks, readers are cautioned not to place undue reliance on the forward-looking statements contained in this presentation or to make predictions based solely on historical financial performance. Any forward- looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. All forward-looking statements, express or implied, included in this presentation are qualified in their entirety by this cautionary statement. 2 Use of Non-GAAP Financial Measures This presentation contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (“GAAP”) and therefore are considered non-GAAP financial measures. The measures entitled tangible common equity, tangible book value, tangible assets, tangible common equity to tangible assets and return on average tangible common equity are not measures recognized under GAAP and therefore are considered non-GAAP financial measures. The most comparable GAAP measures to these measures are stockholders’ equity, book value per share, total assets, equity to assets and return on average equity, respectively. The Company calculates tangible common equity as stockholders' equity less goodwill and intangible assets (net of deferred tax liability ("DTL") and preferred stock. The Company calculates tangible book value ("TBV") per share as tangible common equity divided by the number of shares of common stock outstanding at the end of the relevant period. The Company calculates tangible assets as total assets less intangible assets (net of DTL). The Company calculates tangible common equity to tangible assets as tangible common equity divided by tangible assets. The Company calculates return on average tangible common equity as annualized net income available to common stockholders divided by average tangible equity. The most directly comparable GAAP financial measures are outlined in the non-GAAP reconciliation in the Appendix of this slide presentation. The Company believes that non-GAAP financial measures provide useful information to management and investors that is supplementary to its financial condition, results of operations and cash flows computed in accordance with GAAP; however the Company acknowledges that the non-GAAP financial measures have inherent limitations. As such, these disclosures should not be viewed as a substitute for results determined in accordance with GAAP, and these disclosures are not necessarily comparable to non-GAAP financial measures that other companies use. The Company calculates tangible common equity as stockholders' equity less goodwill and intangible assets (net of deferred tax liability ("DTL") and preferred stock. The Company calculates tangible book value ("TBV") per share as tangible common equity divided by the number of shares of common stock outstanding at the end of the relevant period. The Company calculates tangible assets as total assets less intangible assets (net of DTL). The Company calculates tangible common equity to tangible assets as tangible common equity divided by tangible assets. The Company calculates return on average tangible common equity as annualized net income available to common stockholders divided by average tangible equity. The most directly comparable GAAP financial measures are outlined in the non-GAAP reconciliation in the Appendix of this slide presentation.

Agenda 3 Chuck A. Williams Chairman & CEO Kevin J. Comps President Bradley T. Howes Executive Vice President and CFO • Formal Remarks • Chuck Williams, Chairman & CEO • Kevin Comps, President • Bradley Howes, CFO • Question and Answer Session • Closing Remarks

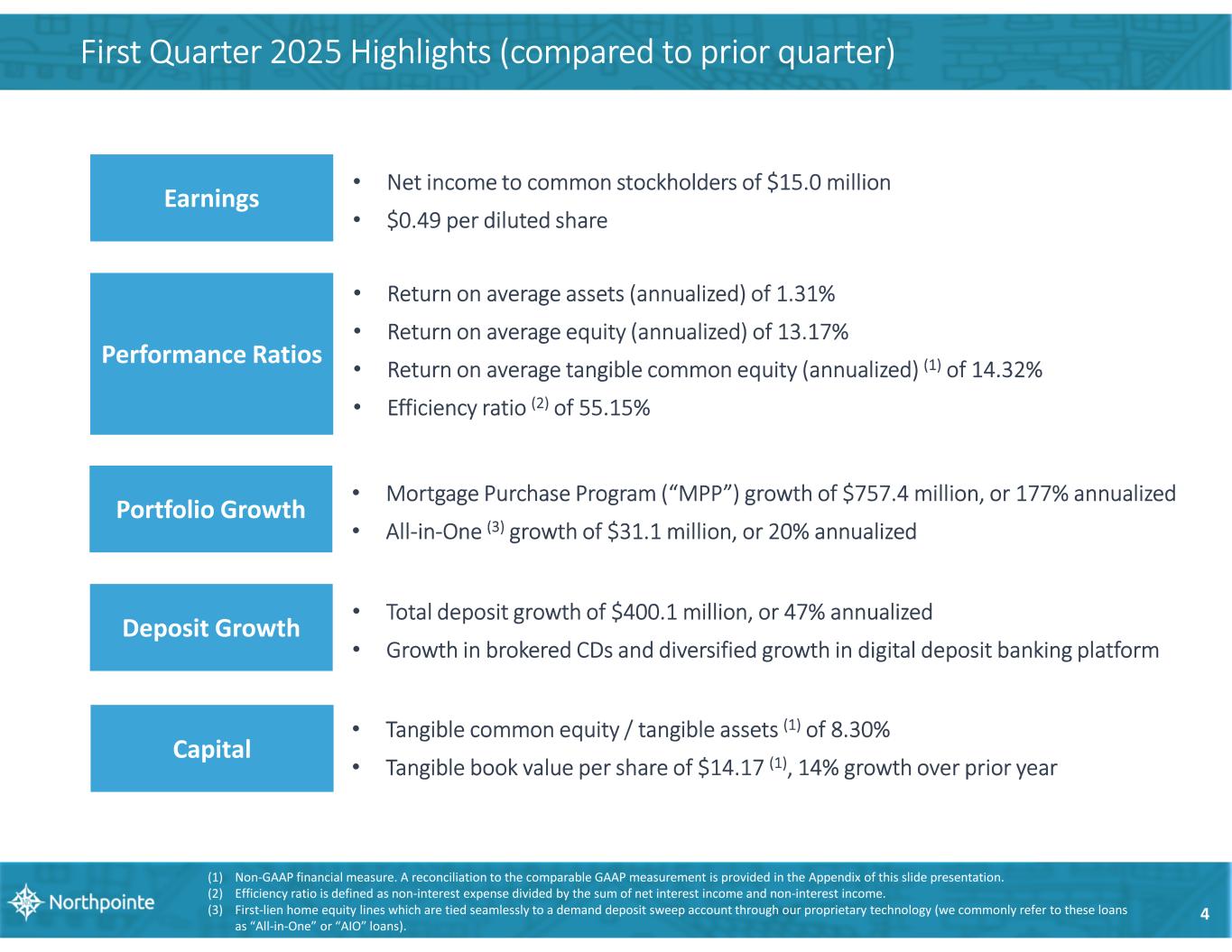

First Quarter 2025 Highlights (compared to prior quarter) 4 Earnings • Net income to common stockholders of $15.0 million • $0.49 per diluted share Performance Ratios • Return on average assets (annualized) of 1.31% • Return on average equity (annualized) of 13.17% • Return on average tangible common equity (annualized) (1) of 14.32% • Efficiency ratio (2) of 55.15% Portfolio Growth • Mortgage Purchase Program (“MPP”) growth of $757.4 million, or 177% annualized • All-in-One (3) growth of $31.1 million, or 20% annualized Deposit Growth • Total deposit growth of $400.1 million, or 47% annualized • Growth in brokered CDs and diversified growth in digital deposit banking platform (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided in the Appendix of this slide presentation. (2) Efficiency ratio is defined as non-interest expense divided by the sum of net interest income and non-interest income. (3) First-lien home equity lines which are tied seamlessly to a demand deposit sweep account through our proprietary technology (we commonly refer to these loans as “All-in-One” or “AIO” loans). • Tangible common equity / tangible assets (1) of 8.30% • Tangible book value per share of $14.17 (1), 14% growth over prior year Capital

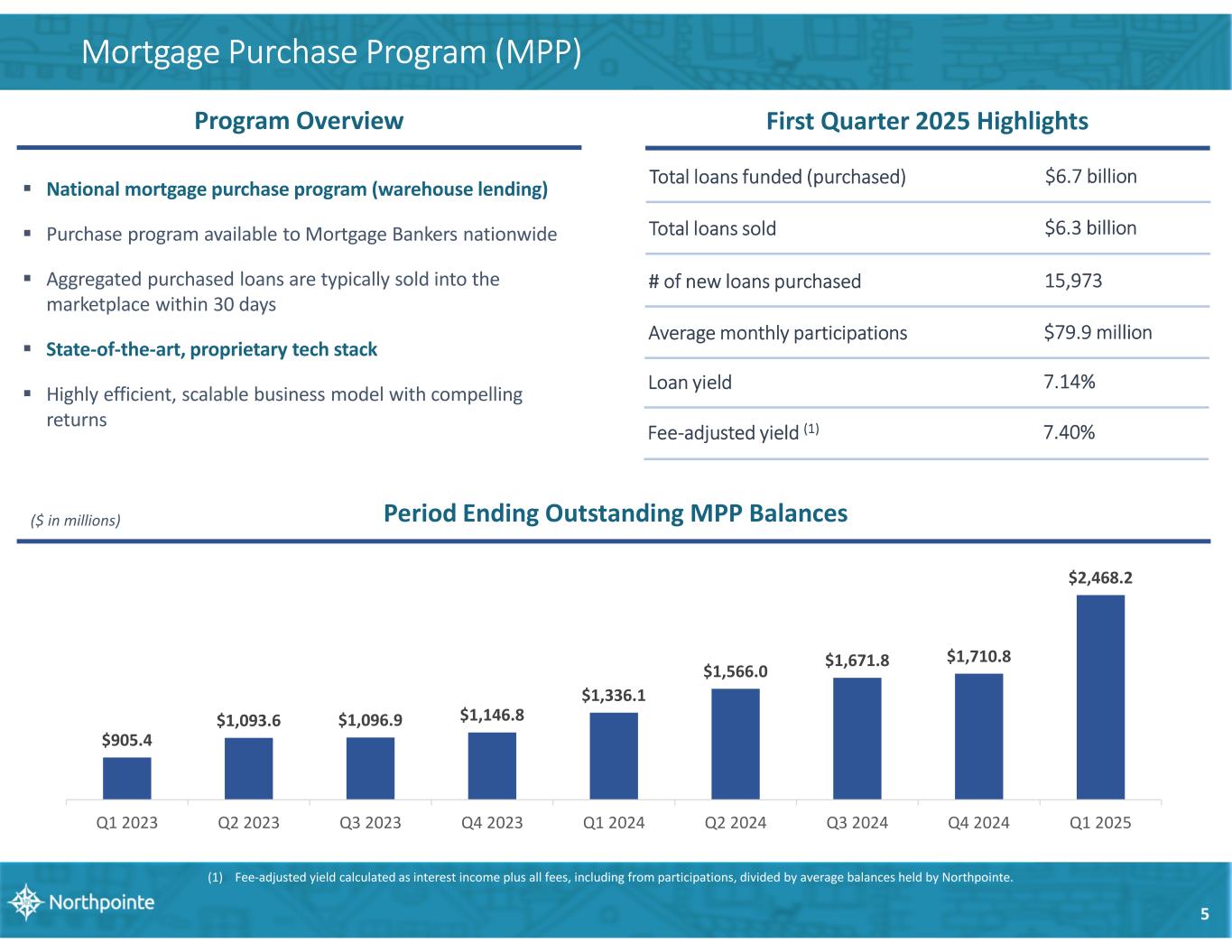

5 Mortgage Purchase Program (MPP) Period Ending Outstanding MPP Balances($ in millions) $905.4 $1,093.6 $1,096.9 $1,146.8 $1,336.1 $1,566.0 $1,671.8 $1,710.8 $2,468.2 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 First Quarter 2025 Highlights Total loans funded (purchased) $6.7 billion Total loans sold $6.3 billion # of new loans purchased 15,973 Average monthly participations $79.9 million Loan yield 7.14% Fee-adjusted yield (1) 7.40% (1) Fee-adjusted yield calculated as interest income plus all fees, including from participations, divided by average balances held by Northpointe. Program Overview National mortgage purchase program (warehouse lending) Purchase program available to Mortgage Bankers nationwide Aggregated purchased loans are typically sold into the marketplace within 30 days State-of-the-art, proprietary tech stack Highly efficient, scalable business model with compelling returns

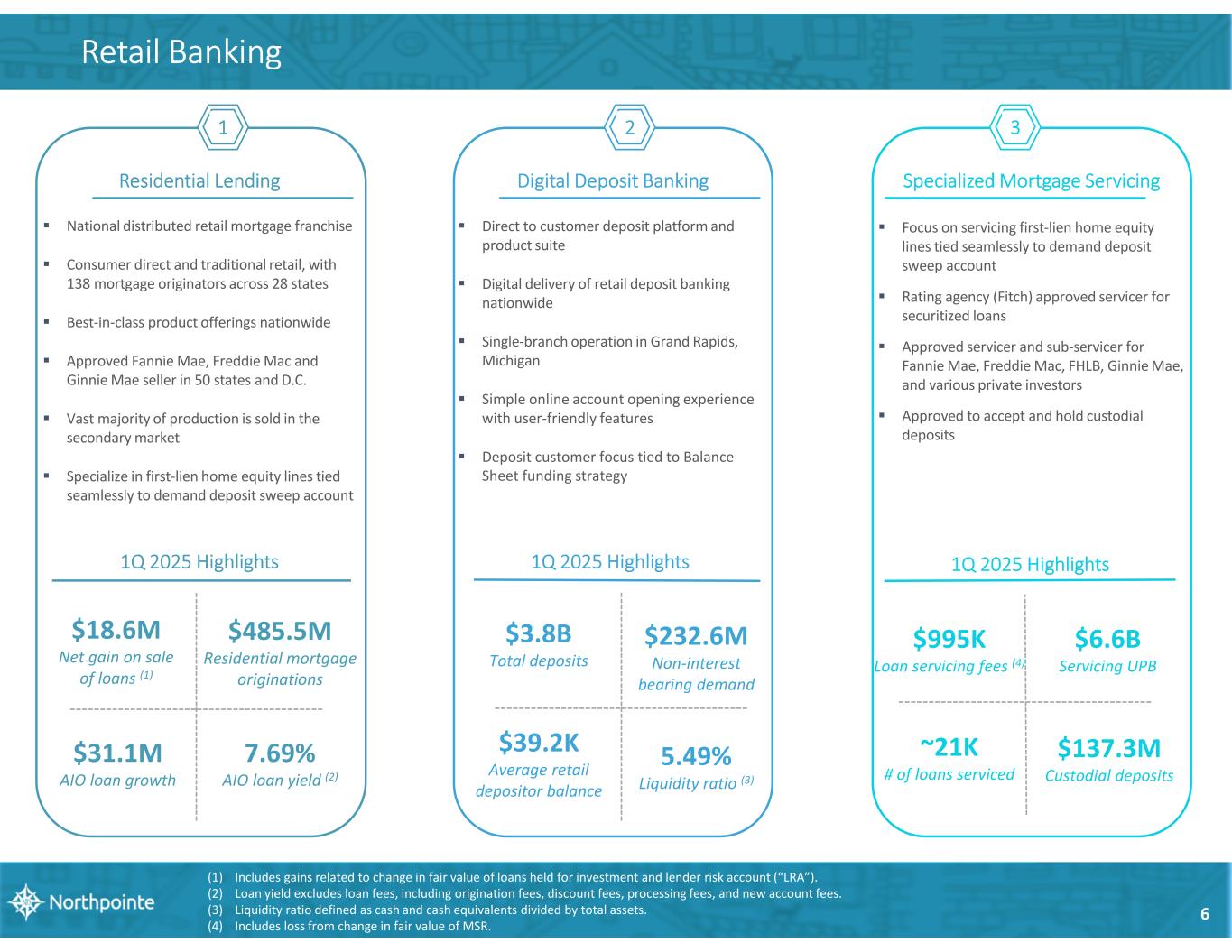

National distributed retail mortgage franchise Consumer direct and traditional retail, with 138 mortgage originators across 28 states Best-in-class product offerings nationwide Approved Fannie Mae, Freddie Mac and Ginnie Mae seller in 50 states and D.C. Vast majority of production is sold in the secondary market Specialize in first-lien home equity lines tied seamlessly to demand deposit sweep account $18.6M Net gain on sale of loans (1) $485.5M Residential mortgage originations 7.69% AIO loan yield (2) Residential Lending 1Q 2025 Highlights $31.1M AIO loan growth Focus on servicing first-lien home equity lines tied seamlessly to demand deposit sweep account Rating agency (Fitch) approved servicer for securitized loans Approved servicer and sub-servicer for Fannie Mae, Freddie Mac, FHLB, Ginnie Mae, and various private investors Approved to accept and hold custodial deposits $6.6B Servicing UPB $995K Loan servicing fees (4) Specialized Mortgage Servicing 1Q 2025 Highlights Direct to customer deposit platform and product suite Digital delivery of retail deposit banking nationwide Single-branch operation in Grand Rapids, Michigan Simple online account opening experience with user-friendly features Deposit customer focus tied to Balance Sheet funding strategy $3.8B Total deposits $232.6M Non-interest bearing demand Digital Deposit Banking 1Q 2025 Highlights $39.2K Average retail depositor balance 5.49% Liquidity ratio (3) ~21K # of loans serviced 6 Retail Banking 1 2 3 (1) Includes gains related to change in fair value of loans held for investment and lender risk account (“LRA”). (2) Loan yield excludes loan fees, including origination fees, discount fees, processing fees, and new account fees. (3) Liquidity ratio defined as cash and cash equivalents divided by total assets. (4) Includes loss from change in fair value of MSR. $137.3M Custodial deposits

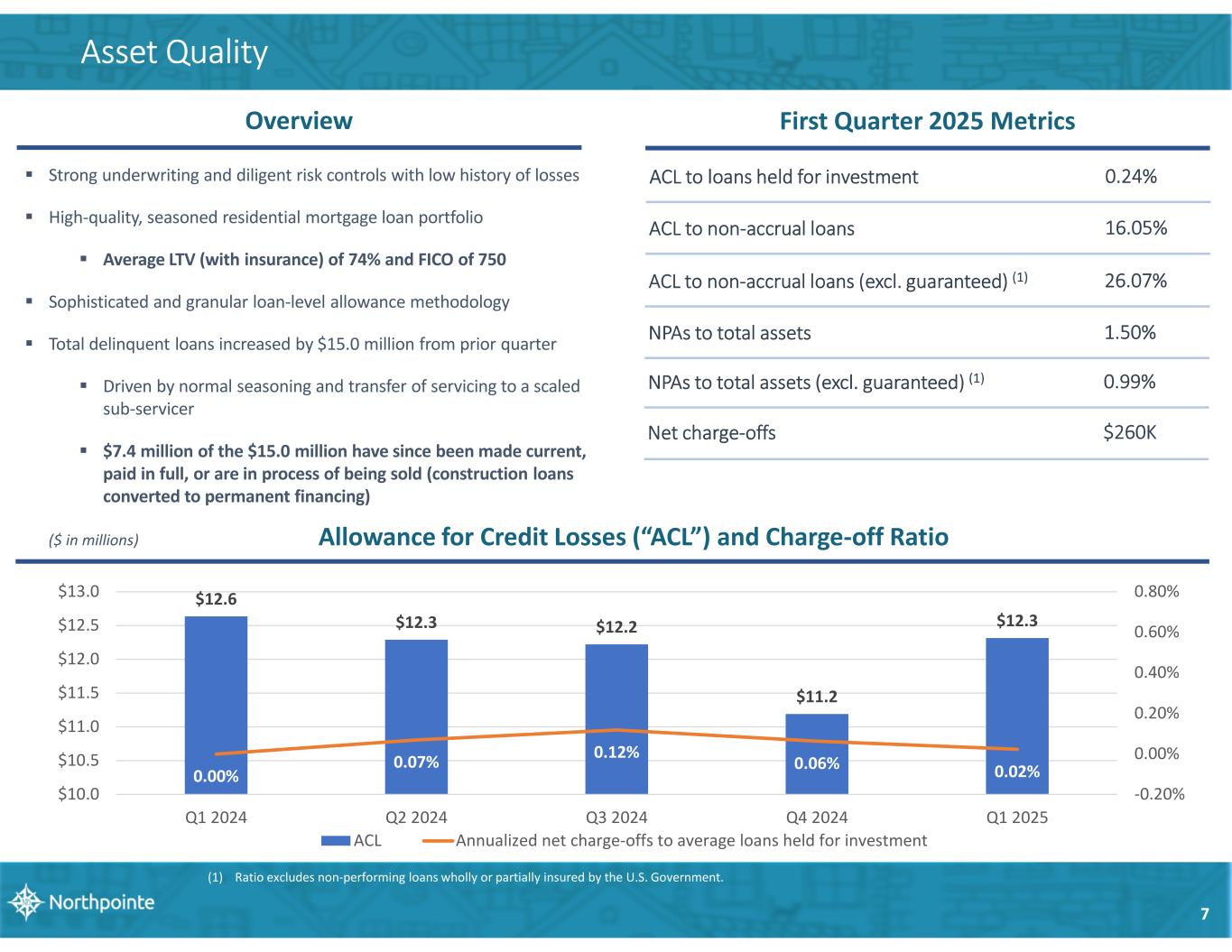

Allowance for Credit Losses (“ACL”) and Charge-off Ratio 7 Asset Quality First Quarter 2025 Metrics ACL to loans held for investment 0.24% ACL to non-accrual loans 16.05% ACL to non-accrual loans (excl. guaranteed) (1) 26.07% NPAs to total assets 1.50% NPAs to total assets (excl. guaranteed) (1) 0.99% Net charge-offs $260K ($ in millions) Overview Strong underwriting and diligent risk controls with low history of losses High-quality, seasoned residential mortgage loan portfolio Average LTV (with insurance) of 74% and FICO of 750 Sophisticated and granular loan-level allowance methodology Total delinquent loans increased by $15.0 million from prior quarter Driven by normal seasoning and transfer of servicing to a scaled sub-servicer $7.4 million of the $15.0 million have since been made current, paid in full, or are in process of being sold (construction loans converted to permanent financing) $12.6 $12.3 $12.2 $11.2 $12.3 0.00% 0.07% 0.12% 0.06% 0.02% -0.20% 0.00% 0.20% 0.40% 0.60% 0.80% $10.0 $10.5 $11.0 $11.5 $12.0 $12.5 $13.0 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 ACL Annualized net charge-offs to average loans held for investment (1) Ratio excludes non-performing loans wholly or partially insured by the U.S. Government.

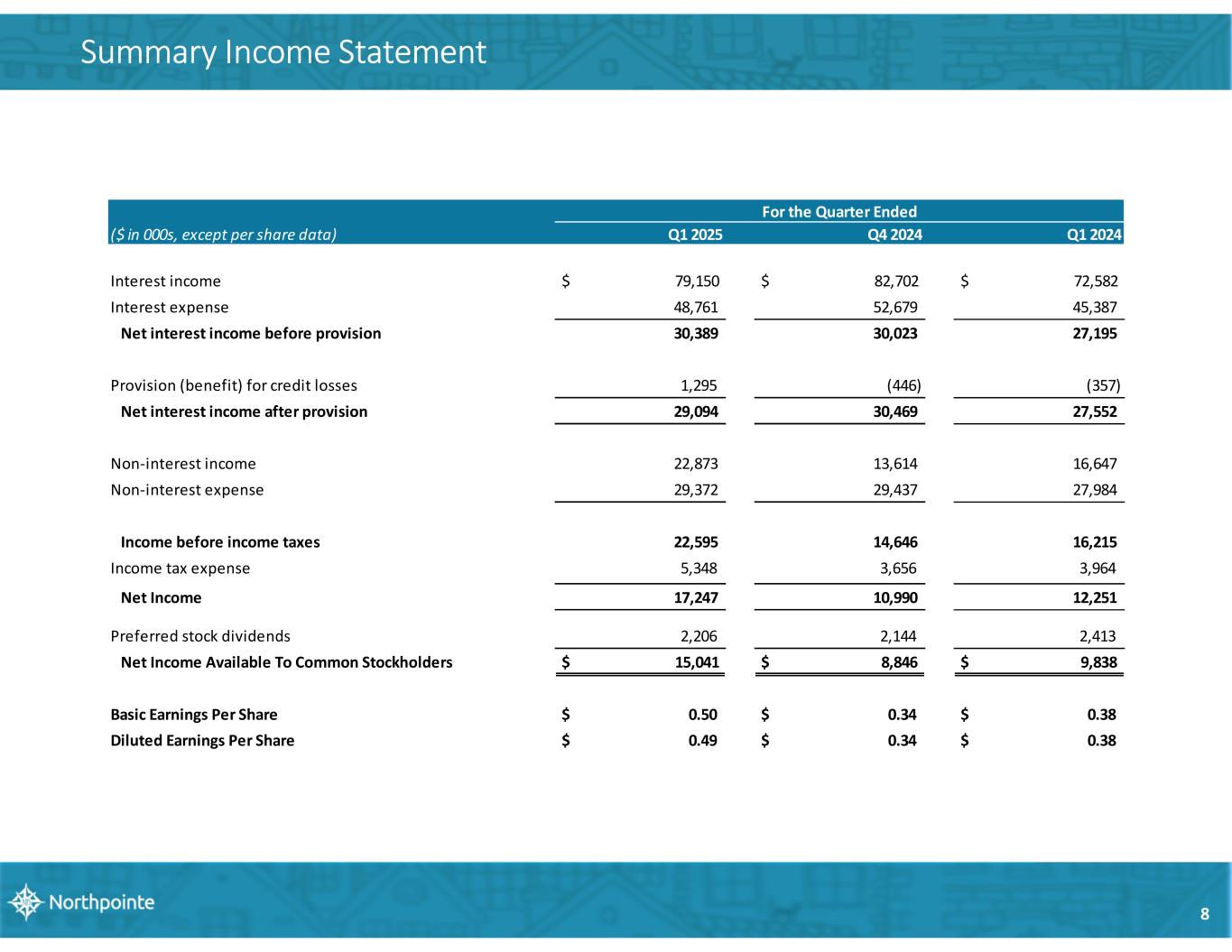

8 Summary Income Statement ($ in 000s, except per share data) Q1 2025 Q4 2024 Q1 2024 Interest income $ 79,150 $ 82,702 $ 72,582 Interest expense 48,761 52,679 45,387 Net interest income before provision 30,389 30,023 27,195 Provision (benefit) for credit losses 1,295 (446) (357) Net interest income after provision 29,094 30,469 27,552 Non-interest income 22,873 13,614 16,647 Non-interest expense 29,372 29,437 27,984 Income before income taxes 22,595 14,646 16,215 Income tax expense 5,348 3,656 3,964 Net Income 17,247 10,990 12,251 Preferred stock dividends 2,206 2,144 2,413 Net Income Available To Common Stockholders $ 15,041 $ 8,846 $ 9,838 Basic Earnings Per Share $ 0.50 $ 0.34 $ 0.38 Diluted Earnings Per Share $ 0.49 $ 0.34 $ 0.38 For the Quarter Ended

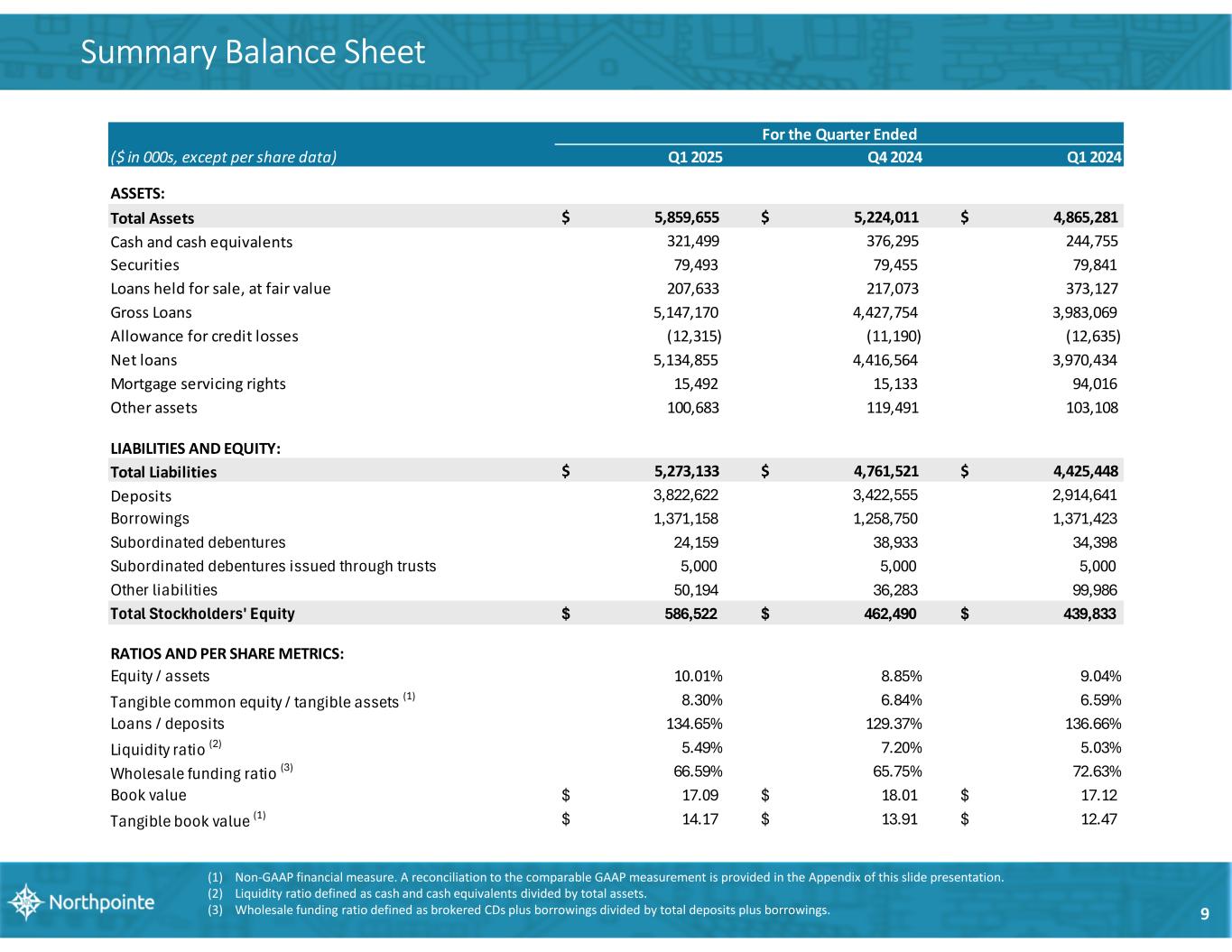

9 Summary Balance Sheet (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided in the Appendix of this slide presentation. (2) Liquidity ratio defined as cash and cash equivalents divided by total assets. (3) Wholesale funding ratio defined as brokered CDs plus borrowings divided by total deposits plus borrowings. ($ in 000s, except per share data) Q1 2025 Q4 2024 Q1 2024 ASSETS: Total Assets $ 5,859,655 $ 5,224,011 $ 4,865,281 Cash and cash equivalents 321,499 376,295 244,755 Securities 79,493 79,455 79,841 Loans held for sale, at fair value 207,633 217,073 373,127 Gross Loans 5,147,170 4,427,754 3,983,069 Allowance for credit losses (12,315) (11,190) (12,635) Net loans 5,134,855 4,416,564 3,970,434 Mortgage servicing rights 15,492 15,133 94,016 Other assets 100,683 119,491 103,108 LIABILITIES AND EQUITY: Total Liabilities $ 5,273,133 $ 4,761,521 $ 4,425,448 Deposits 3,822,622 3,422,555 2,914,641 Borrowings 1,371,158 1,258,750 1,371,423 Subordinated debentures 24,159 38,933 34,398 Subordinated debentures issued through trusts 5,000 5,000 5,000 Other liabilities 50,194 36,283 99,986 Total Stockholders' Equity $ 586,522 $ 462,490 $ 439,833 RATIOS AND PER SHARE METRICS: Equity / assets 10.01% 8.85% 9.04% Tangible common equity / tangible assets (1) 8.30% 6.84% 6.59% Loans / deposits 134.65% 129.37% 136.66% Liquidity ratio (2) 5.49% 7.20% 5.03% Wholesale funding ratio (3) 66.59% 65.75% 72.63% Book value $ 17.09 $ 18.01 $ 17.12 Tangible book value (1) $ 14.17 $ 13.91 $ 12.47 For the Quarter Ended

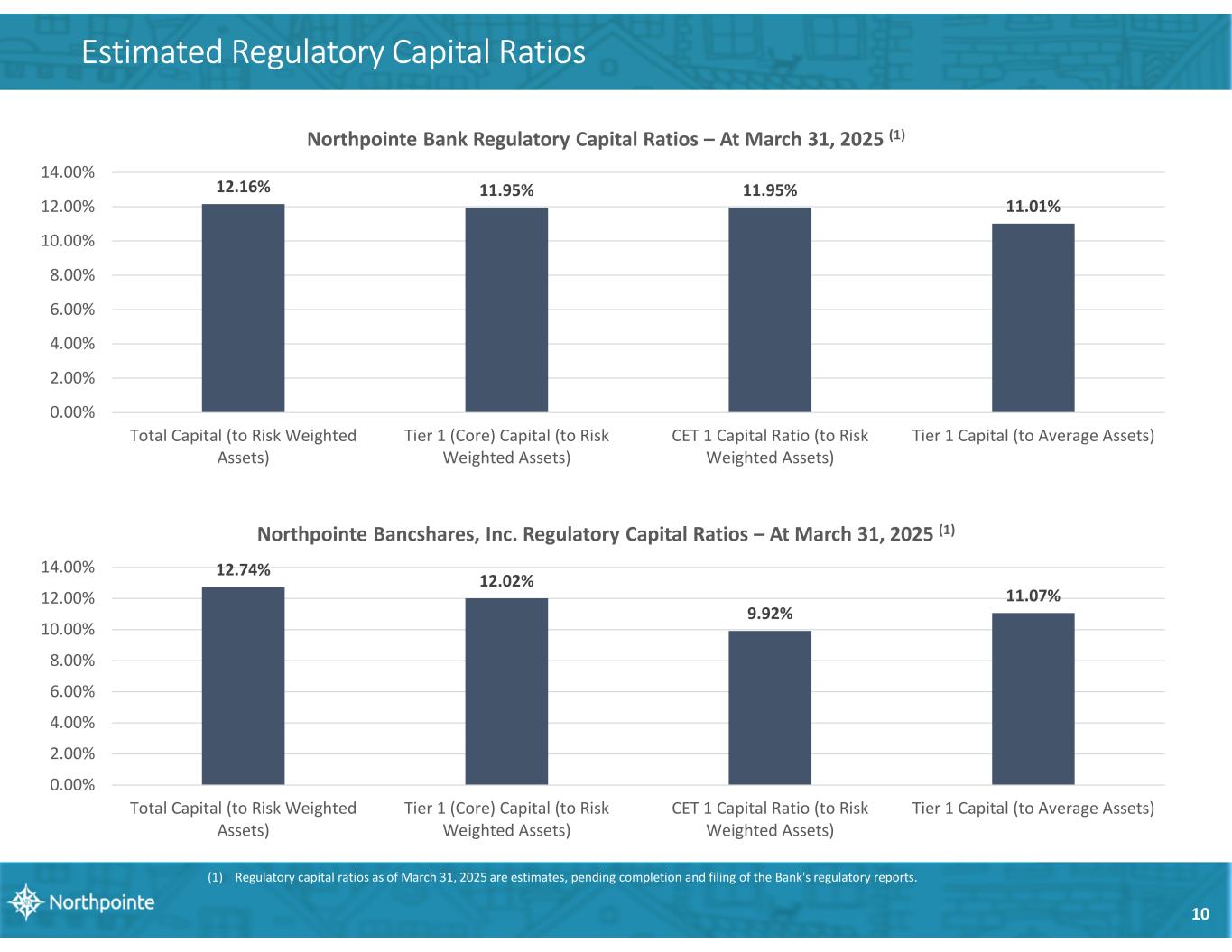

10 Estimated Regulatory Capital Ratios 12.16% 11.95% 11.95% 11.01% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% Total Capital (to Risk Weighted Assets) Tier 1 (Core) Capital (to Risk Weighted Assets) CET 1 Capital Ratio (to Risk Weighted Assets) Tier 1 Capital (to Average Assets) Northpointe Bank Regulatory Capital Ratios – At March 31, 2025 (1) (1) Regulatory capital ratios as of March 31, 2025 are estimates, pending completion and filing of the Bank's regulatory reports. 12.74% 12.02% 9.92% 11.07% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% Total Capital (to Risk Weighted Assets) Tier 1 (Core) Capital (to Risk Weighted Assets) CET 1 Capital Ratio (to Risk Weighted Assets) Tier 1 Capital (to Average Assets) Northpointe Bancshares, Inc. Regulatory Capital Ratios – At March 31, 2025 (1)

APPENDIX

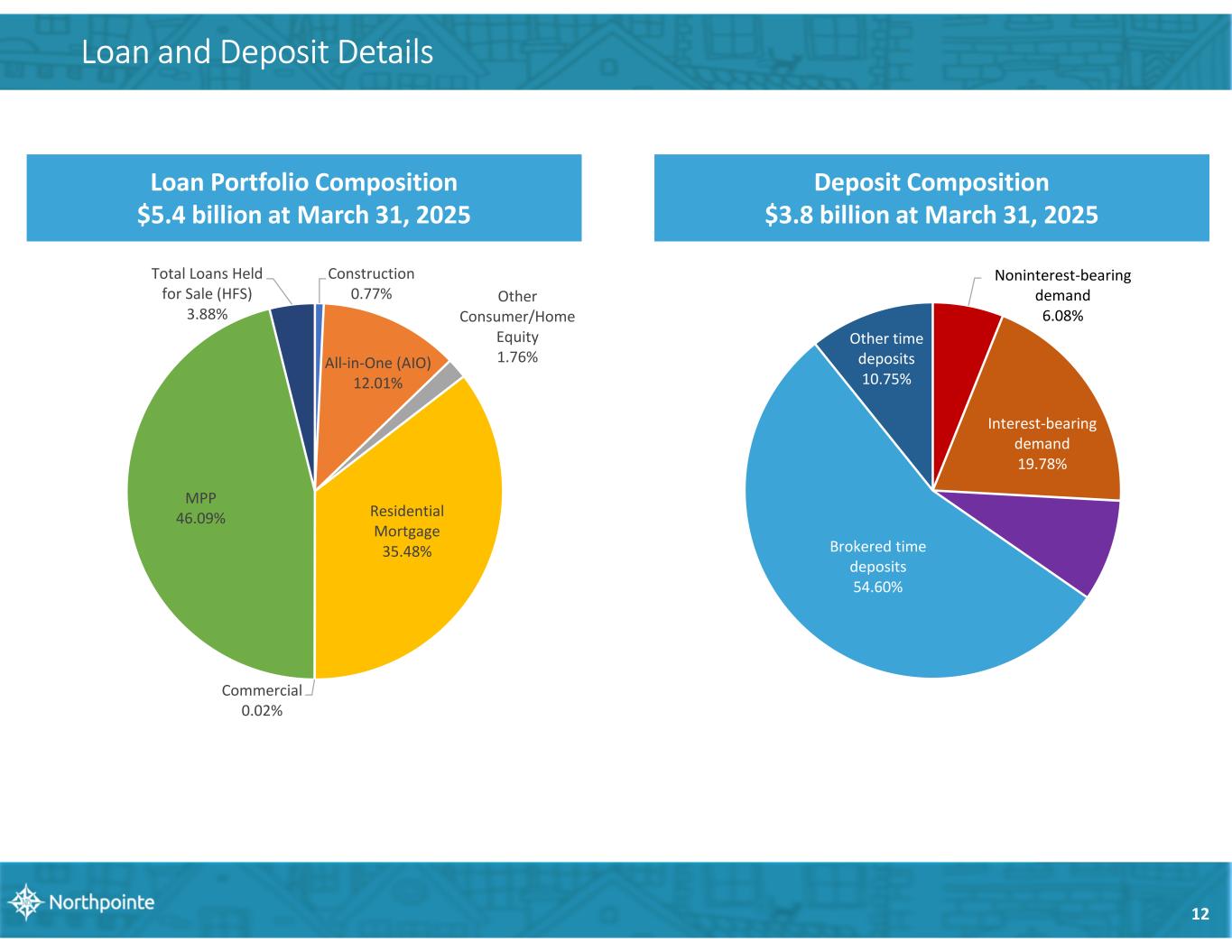

12 Loan and Deposit Details Loan Portfolio Composition $5.4 billion at March 31, 2025 Deposit Composition $3.8 billion at March 31, 2025 Construction 0.77% All-in-One (AIO) 12.01% Other Consumer/Home Equity 1.76% Residential Mortgage 35.48% Commercial 0.02% MPP 46.09% Total Loans Held for Sale (HFS) 3.88% Noninterest-bearing demand 6.08% Interest-bearing demand 19.78% Savings & money market 8.78% Brokered time deposits 54.60% Other time deposits 10.75%

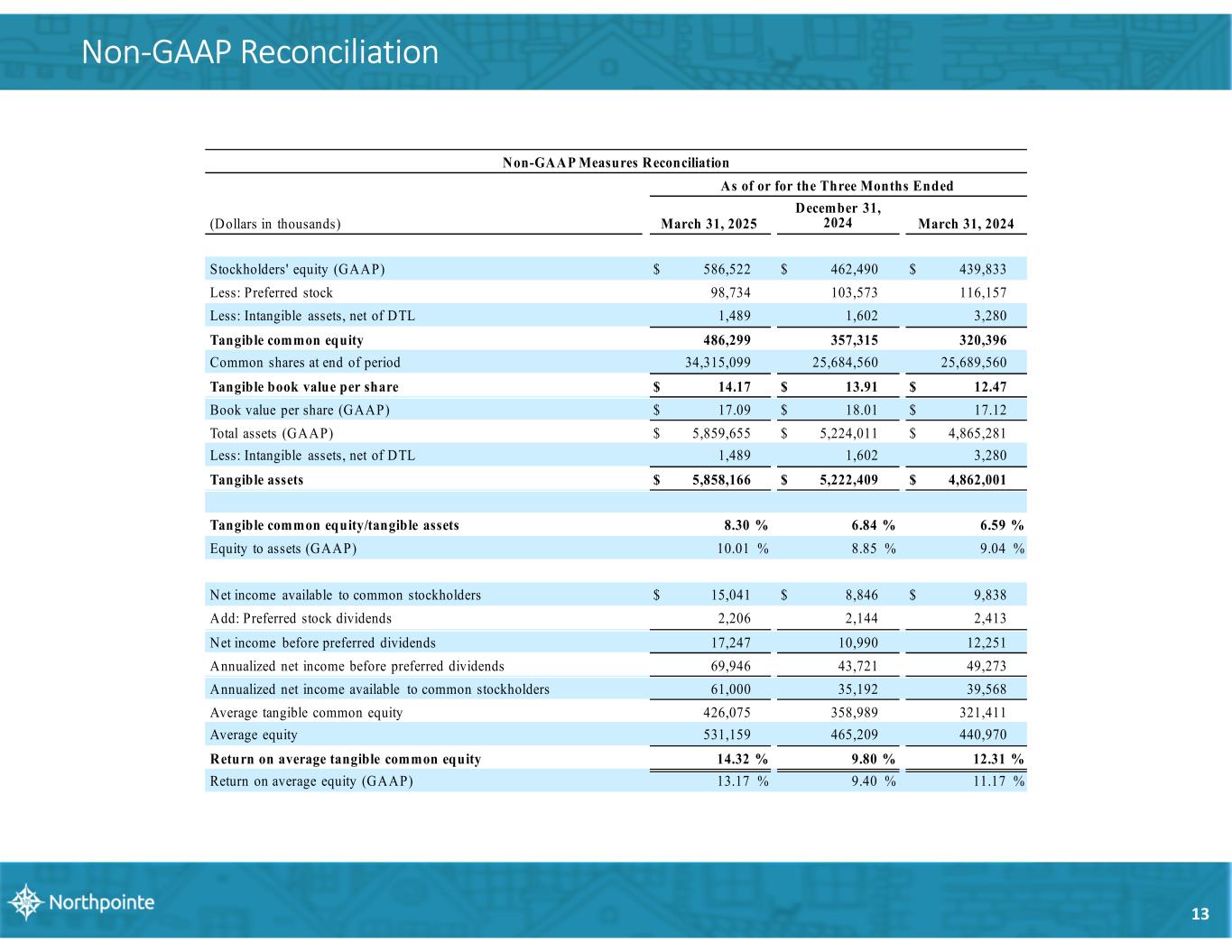

13 Non-GAAP Reconciliation Non-GAAP Measures Reconciliation As of or for the Three Months Ended (Dollars in thousands) March 31, 2025 December 31, 2024 March 31, 2024 Stockholders' equity (GAAP) $ 586,522 $ 462,490 $ 439,833 Less: Preferred stock 98,734 103,573 116,157 Less: Intangible assets, net of DTL 1,489 1,602 3,280 Tangible common equity 486,299 357,315 320,396 Common shares at end of period 34,315,099 25,684,560 25,689,560 Tangible book value per share $ 14.17 $ 13.91 $ 12.47 Book value per share (GAAP) $ 17.09 $ 18.01 $ 17.12 Total assets (GAAP) $ 5,859,655 $ 5,224,011 $ 4,865,281 Less: Intangible assets, net of DTL 1,489 1,602 3,280 Tangible assets $ 5,858,166 $ 5,222,409 $ 4,862,001 Tangible common equity/tangible assets 8.30 % 6.84 % 6.59 % Equity to assets (GAAP) 10.01 % 8.85 % 9.04 % Net income available to common stockholders $ 15,041 $ 8,846 $ 9,838 Add: Preferred stock dividends 2,206 2,144 2,413 Net income before preferred dividends 17,247 10,990 12,251 Annualized net income before preferred dividends 69,946 43,721 49,273 Annualized net income available to common stockholders 61,000 35,192 39,568 Average tangible common equity 426,075 358,989 321,411 Average equity 531,159 465,209 440,970 Return on average tangible common equity 14.32 % 9.80 % 12.31 % Return on average equity (GAAP) 13.17 % 9.40 % 11.17 %